More than half of Singapore’s fastest growing companies are less than 10 years’ old

09 October 2017 [SINGAPORE] – A new breed of ‘young gun’ companies dominate this year’s ranking of the Fastest Growing 50 Companies in Singapore (FG50).

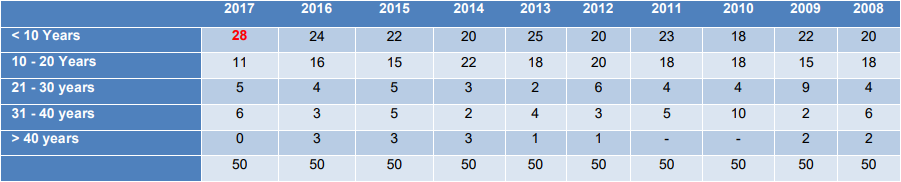

Twenty-eight of this year’s FG50 companies are less than 10 years old. This is the first time in the Ranking’s 16-year history more than half of the winners were incorporated within the last decade, showing the strong contribution newer companies are making to the Singapore economy.

Table1: FG50 Breakdown by Age

The FG50 is compiled by DP Information Group (DP Info), Singapore’s leading provider of credit and business information. DP Info analysed the financial results of more than 70,000 companies to determine the final list of 50 companies.

The FG50 identifies companies that have remained profitable while achieving a minimum of 10 per cent turnover growth for each of the last three years. The qualifying companies are then ranked by their three-year Compounded Annual Growth Rate (CAGR), with the top 50 receiving a FG50 Award.

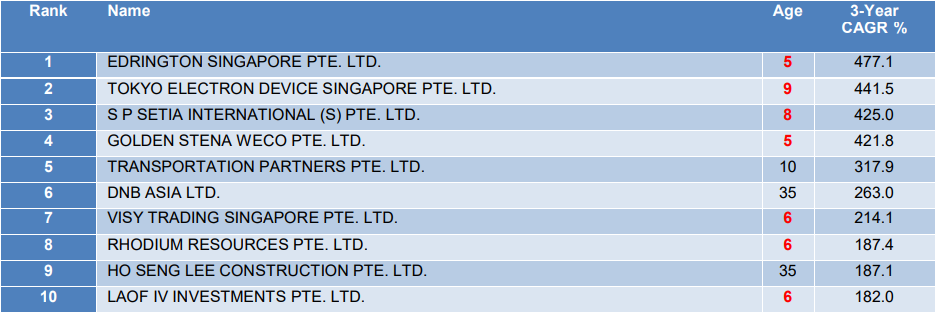

The strong performance of younger companies is even more pronounced among the 10 highest ranked companies. Seven of the top 10 FG50 companies have fewer than 10 years of trading history in Singapore.

Table 2: Top 10 FG50 Companies for 2017

Mr Sonny Tan, General Manager of DP Info said having so many ‘young gun’ companies in the FG50 rankings is a positive sign for Singapore.

“This is the youngest cohort of FG50 winners in the Ranking’s history. These 28 ‘young gun’ companies are a sign of the renewal taking place within Singapore’s corporate sector.”

“Singapore’s economy has long been dominated by large multinationals including many Singaporean home-grown enterprises. This year’s FG50 shows there is a new generation of companies emerging, any one of which could evolve into a corporate leader in the next few years. We believe this is affirmation that some of the new start-ups, with new business approaches and models are substitutable and scalable.”

“Singapore has a reputation for being pro-business. Nowhere is this more evident than in this year’s FG50 rankings, where companies with less than a decade of trading behind them are achieving outstanding growth.”

“With a mix of local and foreign companies making the mix of the Fastest Growing 50 companies, we trust Singapore can act as an attractive regional headquarter to springboard into the region,” Mr Tan said.

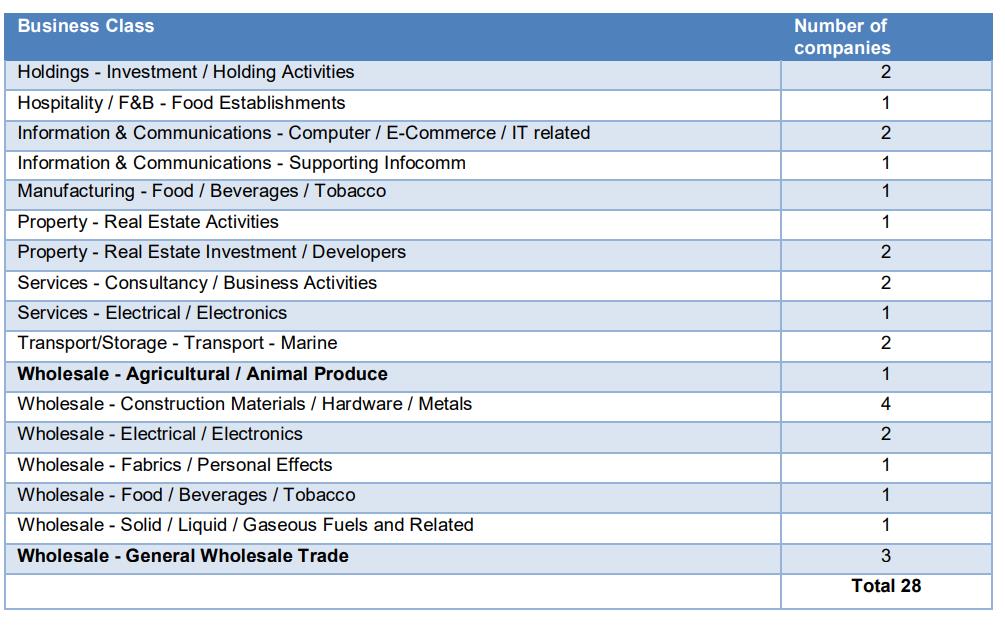

The 28 young gun companies have a diverse range of business models. They are spread across more than 17 different industry sectors, from food and beverage through to property development.

Table 3: 28 FG50 ‘Young Guns’ Breakdown by Industry

SECRETS TO THEIR SUCCESS

DP Info’s analysis of the 28 younger companies shows they have several characteristics which have contributed to their growth.

Internationalisation – Only eight of the 28 young guns are local companies. The other 20 all have overseas holding companies. As a result, they are focused on internationalisation and are likely using Singapore as a regional base due to its pro-business environment. They are more likely to expand their businesses into other countries or export their products to overseas markets.

Technology – Younger companies may have adopted newer technologies to improve productivity and efficiency which helps reduce their costs and increase their profitability. An example would be Tokyo Electron Device Singapore Pte Ltd which launched a new energy conservation system designed for air-conditioners that makes it possible to achieve an approximate 20% reduction in power consumption.

Focused on Trade – While they may service different sectors, 13 of the 28 young gun companies are

focused on international trade and the wholesaling of goods. Four are in the Wholesale – Construction Materials / Hardware / Metals sector. These companies would have benefited from the increase in residential and commercial development last year, resulting in higher demand for their goods.

DP CREDIT RATINGS SHOW SUSTAINABLE GROWTH

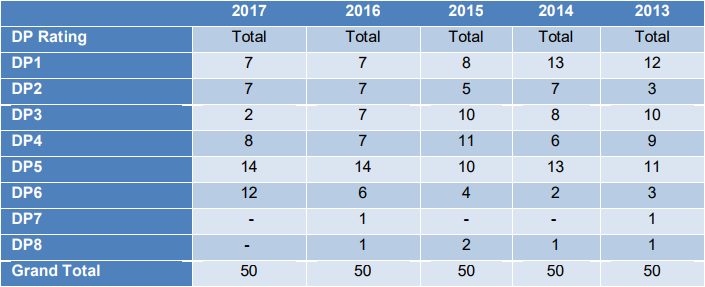

The DP Credit Ratings of the FG50 companies show their growth has been achieved without unnecessarily risking their financial sustainability.

Twenty-four of the 50 companies have a DP1-4 Investment Grade credit rating. This includes seven with the prestigious DP1 rating which indicates extremely strong financial fundamentals.

The majority of companies (26) were graded as DP5 – DP6 High Yield, which is a sign their business model is more heavily geared towards achieving growth.

Importantly, not a single 2017 FG50 company was given a DP7-8 High Risk Credit rating.

Table 4: DP Credit Ratings of the FG50 Companies

Commenting on the DP Credit Rating of the FG50 companies, Mr Tan said the credit profile of the FG50 companies had changed over the last five years as companies tried new ways to increase their revenue.

“The overall credit profile of the FG50 companies is strong. However, there have been changes over time. Five years ago, 34 of the 50 FG50 companies had a DP1 – 4 Investment Grade Credit Rating. This year there are 24.”

“There are a number of factors that contribute to this change, including the tough trading environment faced by many industries, as well as the need to increase leverage to fund productivity improvements and to drive business expansion.”

“The increased number of younger companies in this year’s FG50 list also has an impact on the overall credit profile of the FG50 companies. Smaller and younger companies have had less time to build up their financial resources and assets, which are the key to obtaining a higher credit rating,” Mr Tan said.

EDRINGTON IS SINGAPORE’S FASTEST GROWING COMPANY

The Fastest Growing company this year is Edrington Singapore (Edrington). With its Asian headquarters located in Singapore, Edrington markets some of the world’s best-loved scotch whiskies such as The Macallan, The Famous Grouse, Highland Park, Cutty Sark and The Glenrothes.

Edrington’s rapid growth in Singapore is due to the aggressive growth strategy adopted by its parent company. With an astute diversification strategy, Edrington has expanded its portfolio with a major investment stake in Brugal, the leading premium rum in the Caribbean as well as Snow Leopard vodka, which significantly diversifies the company’s portfolio beyond Scotch whiskey.

Edrington is a leading international premium spirits powerhouse, whose strong reputation in the marketplace has helped established an extensive network of distributors within the Asian region. This has allowed Edrington to massively boost its sales across the lucrative Asian beverage market, leading to it receiving the prestigious FG50 Award.

“Fastest Growing 50” is organised and ranked by DP Information Group, the ranking body of the Singapore 1000 Family of Rankings.