The escalating volume has made it challenging for you to maintain a robust collections framework while ensuring the customer experience with your brand continues to remain superior even during the collections process.

Experian Collections Analytics has guided our clients on using data and scores to determine the right approach during the collection process and reduce collections cost and achieve faster ROI.

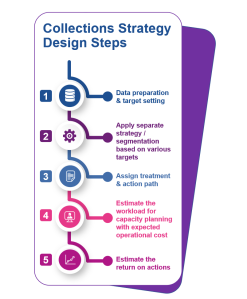

By adopting mid-to-late stage collection scores and recovery models, lenders can priorities their collection operations. Collection scores coupled with intuitive strategies can achieve optimal collection efficiency.

Benefits with Experian Collections Analytics

Monitor your credit portfolios by leveraging bureau benchmarking and industry trends

Automate reviews and adjustments account reviews and triggers, build segmentation, challenger strategies

Deploy updated models to capture recent payment behaviour and economic adjustment

Improvement in accuracy and interpretation

Optimise collections cost by using the right channel and collection effort to maximise resolutions across buckets

Loading…