- Latest survey of 3,600 Singapore SMEs by SBF and DP Info shows SMEs to be mildly optimistic in their business outlook for the next six months

- SMEs are still looking to expand their businesses in light of regional business opportunities, in spite of softer turnover and weaker profitability expectations

- SMEs expect increased capacity utilisation on the back of neutral hiring expectations, with softened access to financing under an environment of increasing interest rates

- SMEs are adopting a wait-and-see approach towards capital investment in the lead up to Budget 2019

SINGAPORE, 14 January 2019 – Singapore SMEs continue to adopt a mildly optimistic outlook for the first six months of 2019 as general sentiments eased across all seven sectors.

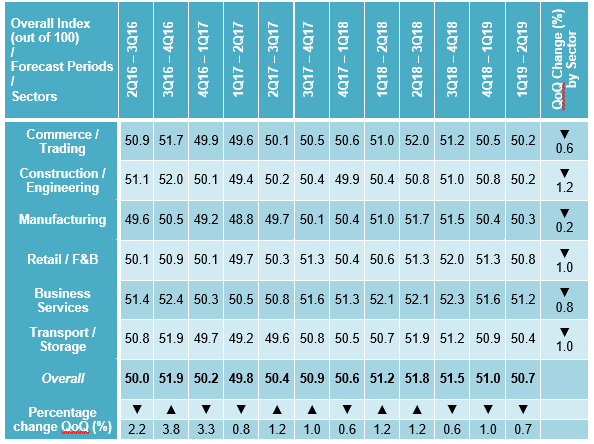

The SBF-DP SME Index (the Index) decreased from 51.0 to 50.7 this quarter, indicating a slight dampening of sentiments among SMEs. This index is based on a survey of more than 3,600 SMEs during October and November 2018.

Despite the outlook, SMEs are looking at continued business expansion, likely due to the regional trade deals that look to open up cross-border business opportunities, albeit with softer turnover and profitability expectations.

The Index – a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info), part of Experian – measures the business sentiment of SMEs for the next six months (January to June 2019). The Index comprises inputs from SMEs on their expectations in seven key areas – Turnover, Profitability, Business Expansion, Capital Investment, Hiring, Capacity Utilisation and Access to Financing.

Figure 1: Outlook for 1Q19 – 2Q19F (January to June)1

Industry Outlook

Singapore SMEs remain cautiously optimistic at 50.7, the eighth consecutive quarter with a reading more than 50. However, this reading is lower than the previous three quarters at 51.0 (4Q2018), 51.5 (3Q2018) and 51.8 (2Q2018).

Turnover growth expectations continue to narrow through an uncertain environment (down 1.7% to 5.13) and this has directly impacted Profitability expectations (down 2.31% to 5.07) as three out of the six sectors being tracked (namely, Construction/Engineering, Commerce/Trading, and Manufacturing) are anticipating negative profit growth.

The recent SME Development Survey 2018 by DP Info, released in early December, saw similar findings with more SMEs anticipating lower turnover for the financial year.

SMEs Still Seeking Business Opportunities

However, the outlook has not dampened SMEs’ appetite for seeking business opportunities through Business Expansion (5.41).

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which came into force on 30 December 2018, and the signing of the ASEAN e-commerce agreements are likely to boost business opportunities in the Business Services sector (up 0.53% to 5.66) and Transport/Storage sector (up 2.10% to 5.36), enabling SMEs to potentially take advantage of the expected increase in business activities in such key sectors.

Similarly, Business Services has the highest reading for Capacity Utilisation expectations (up 0.71% to 7.09) and the Transport/Storage sector saw the biggest hike over the quarter (up 3.38% to 6.93) likely due to the expectation of business expansion.

The study also shows an increase in Capacity Utilisation expectations (up 1.46% to 6.93) on the back of neutral Hiring expectations (5.03), as well as softer Turnover expectations in view of the recent tightening of the labour market in Singapore and heightened uncertainty in markets.

With a softened Capital Investment expectation (down 0.96% to 5.16) for the next six months, most SMEs are taking a wait-and-see stance in light of the uncertain economic outlook. This coincides with companies holding back capital investment commitments ahead of possible changes in Government initiatives and schemes in the upcoming Budget 2019. This was also observed in the first quarter of the past two years where Capital Investment expectations decreased (down 2.60% to 5.14 in 2017 and down 1.15% to 5.22 in 2016) after the year-end season.

Mr James Gothard, General Manager, Credit Services & Strategy SEA of Experian, said, “It is heartening to see that SMEs remain optimistic and are taking advantage of opportunities from Singapore’s extensive network of free trade agreements. SMEs are

likely to look forward to supporting measures announced in Budget 2019 to overcome near-term challenges, as well as enable them to capture future opportunities.”

Mr Ho Meng Kit, CEO, SBF said, “This survey was conducted at the height of US-China trade tensions, which likely impacted sentiments. It is good to see that the appetite for business expansion is still healthy.

Given the on-going trade tensions and slower economic growth climate, it is even more pertinent that our companies stay nimble and are quick to take advantage of opportunities that may arise from the diversion of trade and re-shuffling of global supply chains. They should continue to be on the lookout for business opportunities globally. At the same time, they should continue to innovate and transform, be it in terms of upskilling their workforce or through investments in technology.

With the CPTPP in force and Singapore’s extensive network of Free Trade Agreements (FTAs), the SBF is actively engaging our companies to make effective use of these agreements for sustained growth. Last year, we successfully launched our FTA flagship courses. Outreach seminars on the recently signed FTAs, such as the Singapore-Turkey FTA, the Sri Lanka-Singapore FTA, and the EU-Singapore FTA, were also organised. This year, SBF will continue to organise flagship training courses, as well as outreach seminars on the EUSFTA, the CPTPP and the upgraded China-Singapore FTA. SBF will also continue to organise activities to facilitate business transformation and overseas business opportunities including for up and coming projects such as the city of Amaravati in Andhra Pradesh, India.”

[1]: For Turnover Expectations, Profitability Expectations, Business Expansion Expectations, Capital Investment Expectations, Hiring Expectations and Access to Financing Expectations, a reading above 5 signals growth / expansion while a reading below 5 signals contraction. For Capacity Utilisation Expectations, a reading above 7 signals over capacity, a reading of 7 signals companies are at optimal capacity while a reading below 7 signals companies are below capacity.