- Latest survey of 3,600 Singapore-based SMEs by SBF and DP Info shows cautious, but still optimistic, business outlook for next six months

- Easing of turnover, profitability and capacity utilisation expectations, with tempered business expansion, hiring and capital investment

- Retail and F&B stands out as one of the sectors with strongest outlook due to upcoming festive period and rise of online delivery platforms

SINGAPORE, 08 October 2018 – Singapore SMEs still expect to continue to expand as they move into 2019, but with slightly greater caution than before, according to the latest SBF-DP SME Index (the Index).

The Index – a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info), part of Experian – measures the business sentiment of over 3,600 SMEs for the next six months (October 2018 to March 2019). The Index comprises inputs from SMEs on their expectations in seven key areas – Turnover, Profitability, Business Expansion, Capital Investment, Hiring, Capacity Utilisation and Access to Financing.

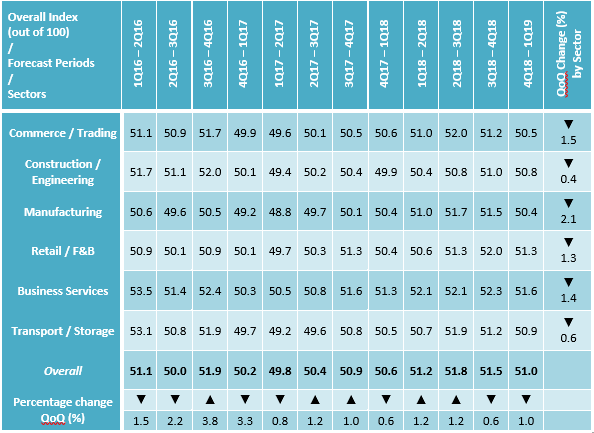

Compared to the last quarter’s index of 51.5, the latest overall outlook for SMEs is slightly moderated, decreasing 1% quarter-on-quarter to 51.0. A score above 50 indicates an expectation of growth, while a score below 50 signals a possible contraction.

SMEs have become more watchful about turnover and profitability. Despite this, SMEs appear to remain cautiously optimistic and continue to proceed with capital investments and business expansion plans, albeit at a slightly contracted rate than in the previous quarter.

Trade tensions affect SME turnover and profitability

At 5.221 (down 2.97%), SMEs’ expectations of overall turnover are still expansionary (above 5.0), although this is slightly less optimistic than before. Every sector surveyed reported a decrease in growth outlook. The sector leading this downward shift is Manufacturing, while the least affected sector is Retail/F&B. This is likely due to upcoming seasonal effects of Christmas and Chinese New Year.

Likewise, SMEs’ outlook on profitability growth has decreased slightly to 5.19 (down 1.89%). Manufacturing again leads this shift because of fears of increased input costs2 . The exception to this trend is the Transport/Storage sector which expects to grow slightly due to increased intra-regional trade especially within ASEAN.

Key sector movements:

- Manufacturing turnover: Down 6.51% to 5.03

- Retail / F&B turnover: Down 1.65% to 5.37

- Manufacturing profitability: Down 6.06% to 4.96

- Transport / Storage profitability: Up 0.77% to 5.25

SMEs continue searching for growth opportunities

Key scores for business expansion and capital investment expectations show SMEs continue to have an appetite for expansion, with some sectors being more optimistic than others.

Business Expansion Expectations scored 5.45 overall (down 0.91%), against a backdrop of mixed sentiments from the different sectors. With the festive season in sight, Retail/F&B leads the growth outlook while the Commerce/Trading sector pulls down the average with its less positive outlook because of increased uncertainty as demand slows.

Despite this, almost all sectors continue to see increased optimism for growth in capital investment expectations, scoring 5.21 overall (up 0.77%). The Construction/Engineering sector leads this shift as smaller firms appear to increase their investments in pace with productivity and collaboration initiatives introduced by the Building and Construction Authority. Only the Retail/F&B sector maintains its previous outlook at a score of 5.18, indicating that companies may be increasingly tapping on online delivery platforms to meet the ecommerce trend rather than doing so through their own capital investments.

Key sector movements:

- Retail / F&B Business Expansion Expectations: Up 3.42% to 5.75

- Commerce / Trading Business Expansion Expectations: Down 5.26% to 5.22

- Construction / Engineering Capital Investment Expectations: Up 1.15% to 5.28

- Retail / F&B Capital Investment Expectations: Flat at 5.18

SMEs march onward on hiring

The outlook on adding talent to businesses remains positive with hiring expectations scoring 5.20 (down 0.19%). This is largely unchanged from the previous quarter.

Digital transformation has resulted in the demand for talent with skillsets to drive change. This has led SMEs in the Retail/F&B sector having the highest expectations as they need a mix of customer service personnel and also those with expertise in online platforms.

The Construction/Engineering sector is the least optimistic in hiring outlook as the sector prepares for an expected slowdown, however its reading remains in growth.

Key sector movements:

- Retail/F&B Hiring Expectations: Down 0.74% to 5.33

- Construction/Engineering Hiring Expectations: Down 0.58% to 5.13

“Singapore SMEs are currently in a growth-conducive environment, and they continue to make plans toward capital investments and business expansion. Confidence in global trade remains key to the strategic goals of many SMEs in sectors such as Manufacturing and Commerce/Trading. The outlook of these 2 sectors leans to a cautious and moderated optimism, given ongoing trade tensions which may affect an open trading economy such as Singapore,” said James Gothard, General Manager, Credit Services & Strategy, Southeast Asia, Experian.

“It is understandable that our SMEs are cautiously optimistic, given the on-going global trade tensions. The trade war between the US and China will have an impact on the global economy. But therein also lies opportunities. Our SMEs should be quick to spot and leverage the opportunities that arise due to the diversion of trade and re-shuffling of global supply chains. At the same time, they should also re-look their business strategies to diversify their markets and sources of inputs, to diversify risks. I strongly encourage our SMEs to tap on Singapore’s extensive network of Free Trade Agreements to strategically mitigate the impact of the increasing international trade tensions, as these agreements are legally binding documents that secure predictability in trade amongst countries. SMEs should also make use of their proximity to the growth markets in ASEAN for future expansion,” said Mr Ho Meng Kit, CEO of the Singapore Business Federation.

[1]: For Turnover Expectations, Profitability Expectations, Business Expansion Expectations, Capital Investment Expectations, Hiring Expectations and Access to Financing Expectations, a reading above 5 signals growth / expansion while a reading below 5 signals contraction. For Capacity Utilisation Expectations, a reading above 7 signals over capacity, a reading of 7 signals companies are at optimal capacity while a reading below 7 signals companies are below capacity.

[2]: https://phys.org/news/2018-05-companies-price-hikes-material.html