- Weak profit outlook continues to trouble SMEs

Singapore, Friday, 29 September 2017 – The sentiment of Singapore SMEs continues to be flat to marginally optimistic, but has yet to be buoyed by recent improvements in the overall economy.

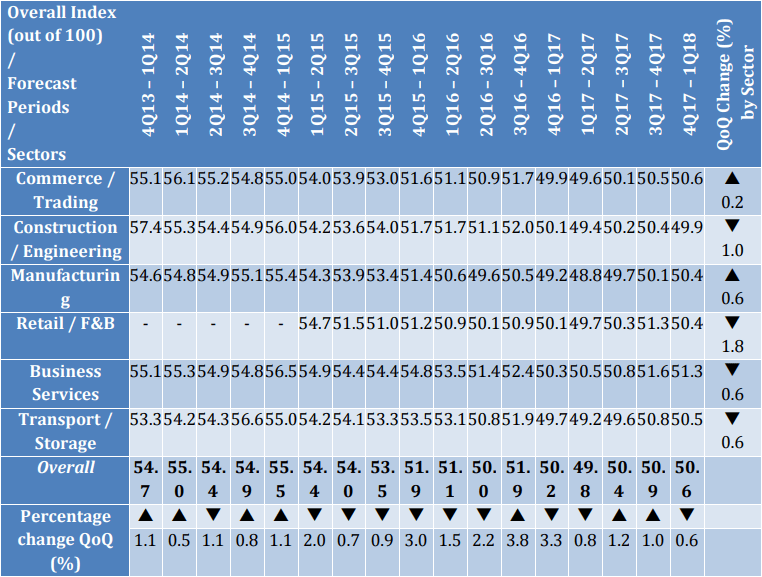

According to the SBF-DP SME Index (the Index), SMEs expect softer trading conditions during the next six months. At a reading of 50.6, the Overall Index has remained in positive territory despite a dip of 0.3 points from last quarter’s survey.

The Index measures the business sentiment of SMEs for the next six months (Q4 of 2017 and Q1 of 2018) and is a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info). More than 3,600 SMEs were surveyed in July and August on their outlook.

There has been good news on the Singapore economy lately, with GDP growth accelerating, exports increasing, manufacturing performing strongly, and demand for labour on the up. Notwithstanding the recent positive economic news, the sentiments of SMEs have remained cautious.

So while larger local companies and multinationals may be enjoying better trading conditions, the improvements have not flowed down to the SME community yet.

Table 1: Outlook for 4Q17 – 1Q18F (September to March)

Business Services continue to be the most optimistic sector with an Overall Index Score of 51.3, albeit at a slightly lower reading than the 51.6 score last quarter. The sector continues to be supported by corporate demand for IT and consultancy services. After a sustained period of Business Expansion, SMEs in the sector are beginning to shift their focus away from expansion towards sustaining their current business operations.

The Construction / Engineering sector recorded a pessimistic score of 49.9 – a drop of 0.5 points compared to the last Index. The Construction sector has been hit by a reduction in project activities from both the private and public sector. Turnover (4.85) and Profitability Expectations (4.67) in the Construction / Engineering sector continue to be weak.

COMMENTS FROM SBF

Mr Ho Meng Kit, CEO of the Singapore Business Federation said that although SME sentiment is above the 50 threshold, it remains stuck in weak territory.

“With the improved export performance, upgrade of our GDP growth for 2017 and improving employment numbers, we were expecting a quicker lift of the SME sentiment. But this was not so. This is reminiscent of a two-speed economy with growth and pick up confined to certain sectors and companies.”

It is likely that SMEs’ sentiment will continue to be muted. Weaker turnover and continued cost pressures have compressed margins. With poorer balance sheets on the back of muted turnover expectations, this has also weakened SMEs’ access to financing expectations for all sectors. The financial performances of our SMEs should be closely watched in the months ahead,” Mr Ho said.

PROLONGED PERIOD OF LOWER PROFITS

For the fifth consecutive quarter, Singapore’s SMEs are pessimistic about their ability to generate profits, with many expecting their bottom line to go backward or even slip into the red. SMEs are experiencing a protracted period of constrained profitability with the situation expected to get worse in the next six months.

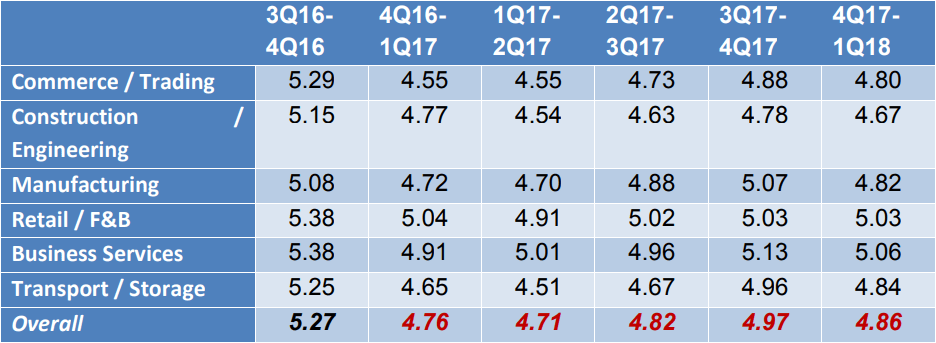

The Profit Outlook Score for this quarter is 4.86, down from 4.97 last quarter. A score below 5.0 indicates SMEs expect their profit performance to decline during the next six months.

Table 1: Expectation on profitability for the next six months 4Q17 – 1Q18

Five of the six industries indicated that their profit performance is expected to worsen, with Retail / F&B indicating they expect no change from their current position. The industry that expects the worst profit performance is the Construction / Engineering sector (4.67) followed by the Commerce / Trading sector (4.80).

The causes of the pessimism towards profits include the relatively muted global and domestic economy, downward pressure on margins due to competition, as well as the high cost of inputs such as raw materials and labour.

COMMENTS FROM DP INFO

Mr Sonny Tan, General Manager of DP Info said as SMEs enter their second year of restricted profits, they need to take precautions to protect their businesses.

“A long period of slim profits or losses places pressure on the cash flow position of SMEs, making it difficult for them to meet their financial obligations promptly. Many will slow down their payments to suppliers to conserve their working capital, while in the worst cases, they may default on debts.”

“When one SME defaults on a debt, it makes it harder for the creditor company to meet its obligations. There is a ripple effect as the creditor company may also slow down its payments to companies it owes money to.”

“Data from the DP SME Commercial Credit Bureau confirms the impact low profits are having on the payment behaviour of SMEs, with the percentage debts paid on time falling to just 37 per cent in the second quarter of 2017 – the lowest level in two years.”

“There are steps SMEs can take to protect themselves, starting with reviewing the credit terms they are offering customers to ensure they maintain adequate cash flow for their business”, Mr Tan said.