- More companies planning capital investments as access to funding improves

Singapore, Thursday, 30 March 2017 – The sentiment of Singapore SMEs has improved slightly despite the outlook for sales and profits remaining sluggish.

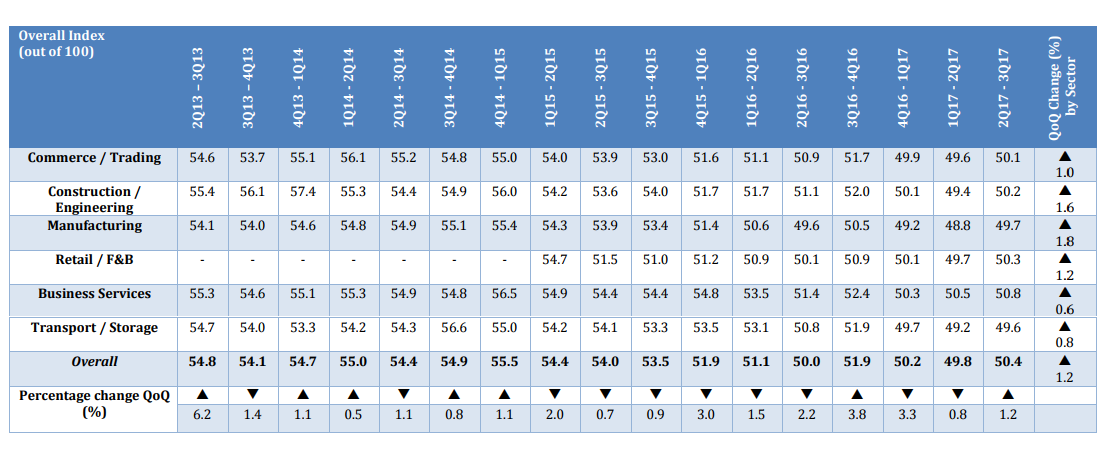

The latest SBF-DP SME Index rose by 0.6 points or 1.2 per cent to 50.4, indicating SMEs are no longer pessimistic about their prospects, and are expecting some growth in the next six months.

The Index measures the business sentiment of SMEs for the next six months (Q2 and Q3 of 2017) and is a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info). More than 3,600 SMEs were surveyed in January and February 2017 on their outlook and sentiment.

The improvement in sentiment is welcome after last quarter’s score of 49.8, which was the first time the index had ever fallen below 50.0 to indicate a state of pessimism.

The most positive aspect of this quarter’s index is that all seven industry sectors have improved their outlook – even if some of the gains are marginal.

Table 1: Outlook for 2Q17 – 3Q17F (April 2017 to September 2017)

TURNOVER AND PROFITS

The Index shows turnover and profits are both expected to contract during the next six months. However, the rate of contraction is slowing.

The Turnover Outlook Expectations Score rose by 0.1 points from 4.83 to 4.93 indicating the outlook has improved but is still indicating a reduction in sale. Only the Retail/Food & Beverage (5.07) and Business Services (5.05) sectors expect any turnover growth between now and September.

SMEs also expect their profits to fall, despite a slight improvement in their outlook. The Overall Profitability Expectations Score increased from 4.71 to 4.82, which indicates many SMEs have reduced profit margins.

CAPITAL INVESTMENT AND ACCESS TO FUNDING

SMEs are taking action to improve their productivity and capacity by making new capital investments. The Overall Capital Investment Expectations Score rose by 0.96 per cent to 5.27. All industry sectors expect their level of capital investment to increase in the next six months, except for Business Services.

Another positive is the improvement in the Overall Access to Funding Expectations Score which, after a two-quarter decline, rebounded by 5.51 per cent to 4.98. The improvement in confidence to access financing was observed across all sectors, particularly in Construction / Engineering which recorded the biggest improvement of 11.21%.

COMMENTS FROM SBF

Mr Ho Meng Kit, CEO of SBF, said “SMEs’ sentiment has rebounded slightly from a historic low of 49.8 to 50.4 for 2Q17 to 3Q17. This is positive news aligned with the better outlook of the global economy and a more upbeat assessment of the

Singapore economy for 2017. It is too early to say that the worse is behind us for the SME sector. Whilst there are some indications that SMEs are adapting to the changing economic climate and technological advances, we have not detected a firm trend of improvement.

For example, in the Retail/F&B Sector, the Business Expansion Expectations index dipped 0.16 points from 5.79 to 5.63, this is to be expected as the sector is faced with structural issues. Yet companies in this sector have raised their Capital Investment Expectations. This could indicate that companies are investing in automation and innovation to create efficiency and grow new revenue streams amid changing consumer habits and developments in e-commerce. This is a welcomed development if the trend holds.

SBF encourages SMEs to work with respective government agencies and relevant TACs in the Industry Transformation Maps (ITM) and leverage on them for transformation and growth.”

COMMENTS FROM DP INFO

Mr Sonny Tan, General Manager of DP Info said the current business environment faced by SMEs was challenging.

“Singapore is experiencing a period of slower growth, which is placing restraints on the growth small and medium sized companies can achieve. SMEs need to adjust to slower sales growth while managing ongoing cost pressures such as high rents and wages.”

“The good news is that SMEs are still prepared to make capital investments. This is welcome as it shows SMEs are confident enough to commit additional funds into the growth of their businesses.”

“Improvements in accessing funding will also help SMEs looking to expand their businesses or invest in equipment to boost productivity or capacity,” Mr Tan said.