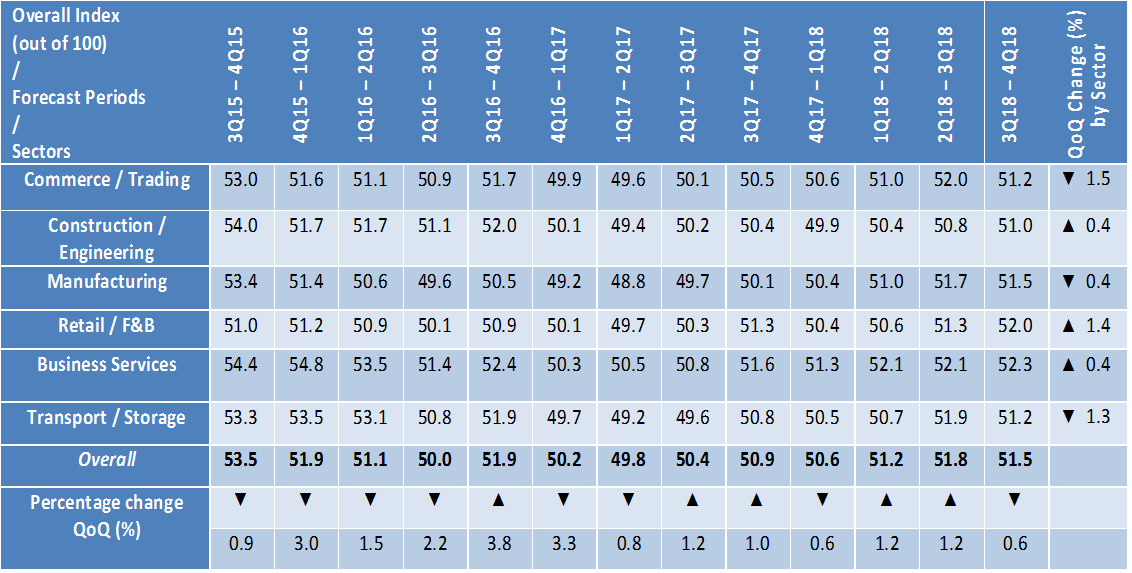

Singapore, Tuesday, 19 June 2018 – Singapore’s SMEs remain upbeat about their prospects for the next six months, expecting a period of slow but steady growth, according to the latest SBF-DP SME Index (the Index).

The Index remained relatively stable from the previous quarter, shifting marginally from 51.8 to 51.5, which indicates that SMEs continue to be optimistic.

The Index measures the business sentiment of SMEs for the next six months (July to December) and is a joint initiative of the Singapore Business Federation (SBF) and DP Information Group (DP Info), part of the Experian Group of companies. The index is based on a survey of more than 3,600 SMEs during April and May 2018.

Figure 1: Outlook for 3Q18 – 4Q18F (July to December)

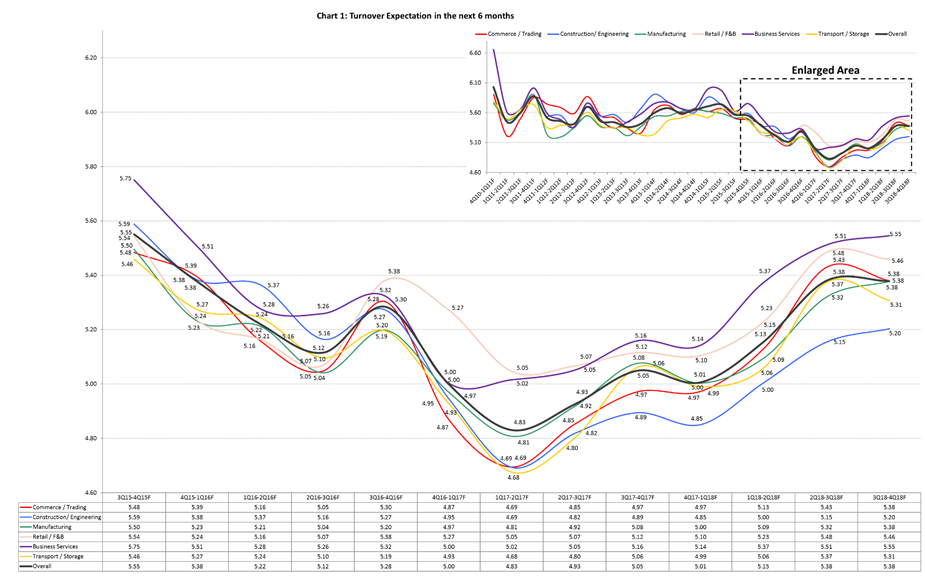

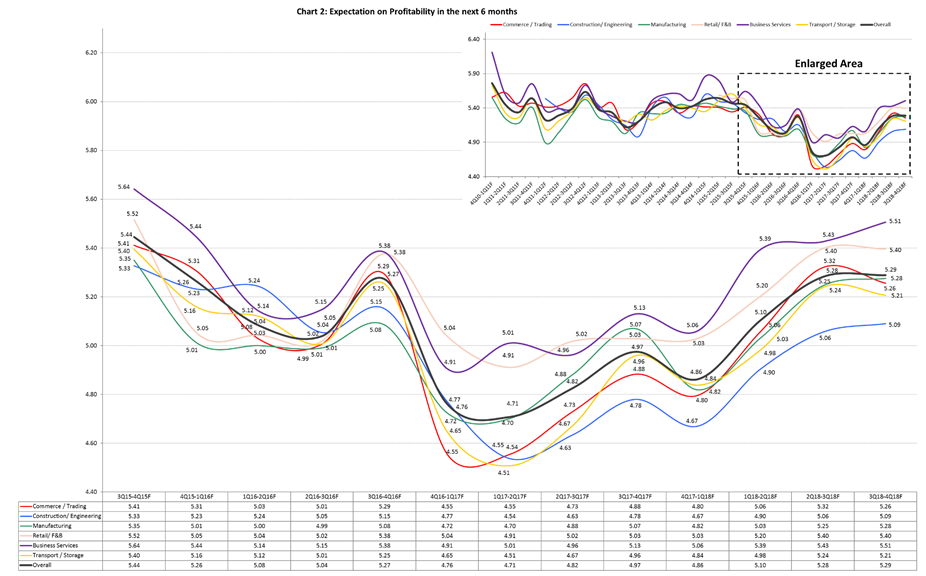

The outlook for SME turnover and profits both remained in positive territory with minor movements from the previous quarter. The Turnover Expectations Score for all SMEs was the same as last quarter at 5.38, while the Profitability Expectations Score stayed positive from 5.28 to 5.29.

INDUSTRY OUTLOOK ANALYSIS

The Business Services sector had the highest overall Index Score of 52.3. It also had the highest Turnover Expectations Score (5.55) and Profitability Expectations Score (5.51).

Business Services is the most consistently optimistic industry in Singapore, never once recording a score indicating pessimism and contraction (i.e., an Overall Score below 50.0).

The Business Services sector provides support to diversified industries and includes activities such as management consultancy, training and professional consultancy. While other sectors might experience seasonal or cyclical shifts in performance, the need for business services remains steady.

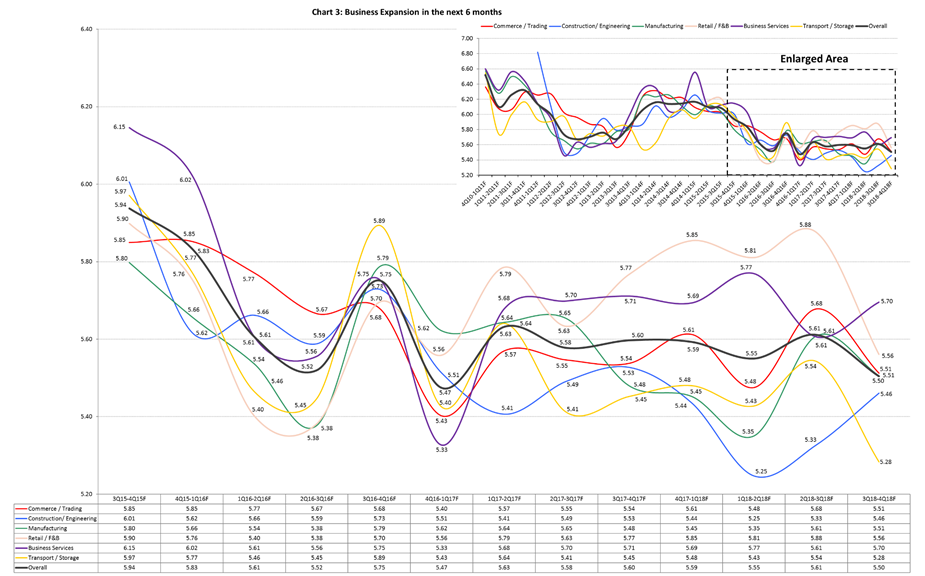

The largest improvement in outlook came from the Retail / Food and Beverage (F&B) sector, whose Overall Index Score rose from 51.3 to 52.0. Last quarter, Retail/F&B SMEs were the most bullish on their business expansion and hiring expectations, a combination that indicated an intention to expand their operations. This quarter they may be enjoying the rewards of their growth strategies, which have lifted their spirits and outlook with the approach of the year-end festivities.

COMMENTS FROM SBF

Mr Ho Meng Kit, CEO of the Singapore Business Federation said “Notwithstanding regional and international geopolitical tensions, as well as the ongoing trade disputes between US and China, SMEs remain cautiously optimistic about their business outlook for the second half of this year”.

“In spite of the looming uncertainties, I encourage our SMEs to think long-term, leverage the supportive Government economic policies and continue with their efforts to transform their companies to be more innovative and competitive. SBF will continue to work with other Trade Associations and Chambers and Government to promote the growth and vibrancy of our SMEs”, he added.

COMMENTS FROM DP INFO

Mr James Gothard, General Manager, Credit Services & Strategy, South East Asia, Experian said SMEs would welcome a steady period of growth.

“SMEs foresee stability, which is good news. After coming through one of the most tumultuous and unpredictable decades in memory, a period of steady progress would be welcome.”

“The more consistent and predictable a company’s performance, the easier it is for managers to plan the resources and cashflow required to fund growth. Consistency breeds confidence in the mind of SME managers, where volatility makes them nervous and risk-averse.”

“The one industry which has been enjoying consistency is Business Services. They have topped the rankings for optimism every quarter for the last four years. Singapore companies not only provide services to local companies, but to the many regional and multinational corporations headquartered here.”

“The Retail/F&B is sector is one to watch. Just 15 months ago they were predicting their businesses would shrink. Today their outlook is improving faster than any other sector.”

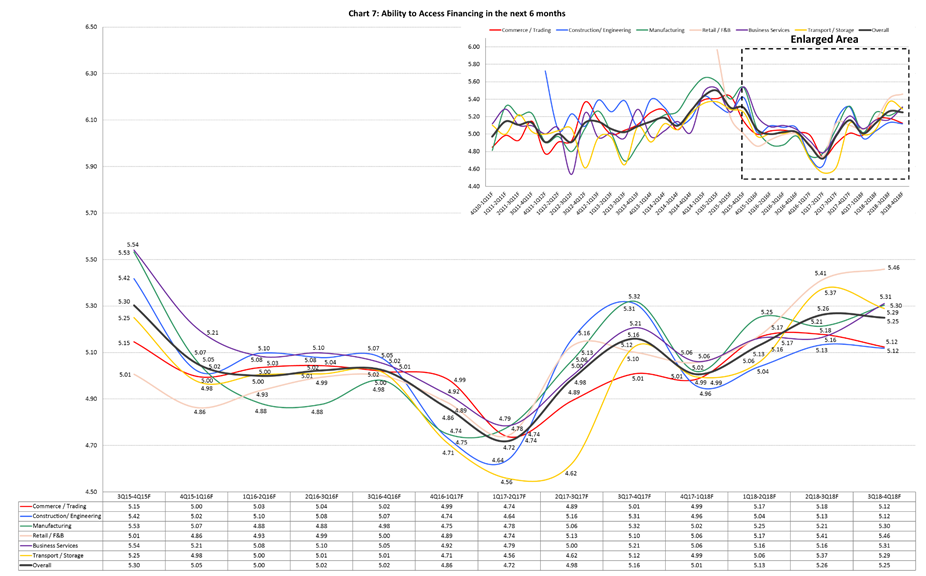

“During the last few quarters Retail/F&B SMEs have been hiring, making capital investments and gaining easier access to funding. As a stronger economy fuels consumer confidence, these F&B companies have become increasingly positive about their future,” Mr Gothard said.

For more information, please contact:

|

Randall Tan Singapore Business Federation DID: +65 6827 0255 randall.tan@sbf.org.sg |

Laura Cheng Singapore Business Federation DID: +65 6827 6864 laura.cheng@sbf.org.sg |

|

Lorraine Chua Rubicon Consulting Pte Ltd Mobile: +65 9819 9151 lorraine@rubicon.com.sg |

April Ng DP Information Group DID: +65 6507 2340 april.ng@experian.com |

(A) Turnover Expectations

For Turnover Expectations, Profitability Expectations, Business Expansion Expectations, Capital Investment Expectations, Hiring Expectations and Access to Financing Expectations, a reading above 5 signals growth / expansion while a reading below 5 signals contraction. For Capacity Utilisation Expectations, a reading above 7 signals over capacity, a reading of 7 signals companies are at optimal capacity while a reading below 7 signals companies are below capacity.

(B) Profitability Expectations

(C) Business Expansion Expectations

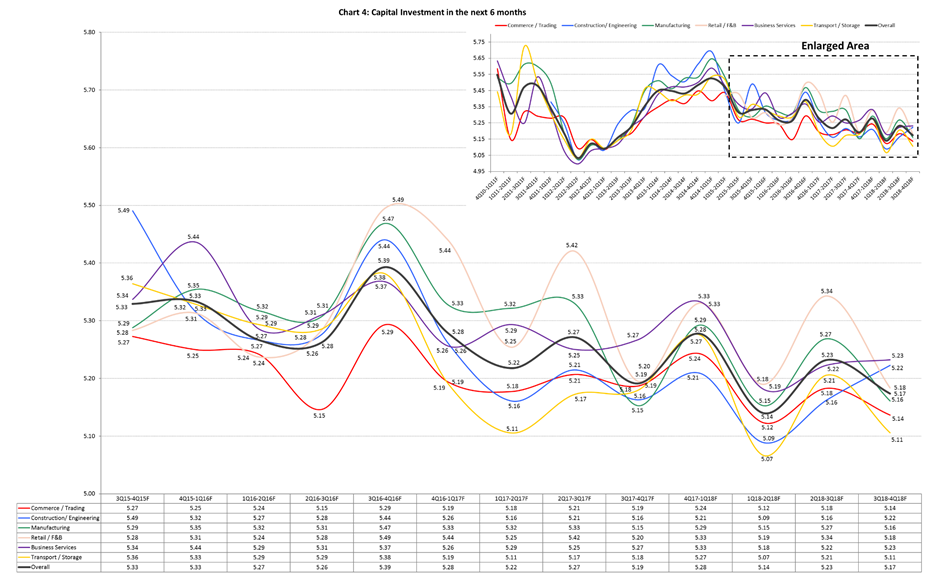

(D) Capital Investment Expectations

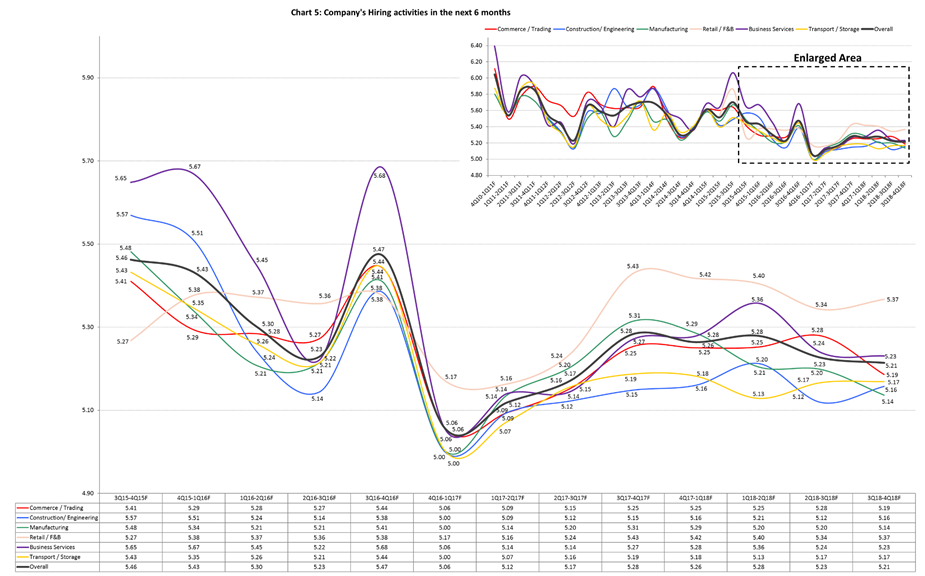

(E) Hiring Expectations

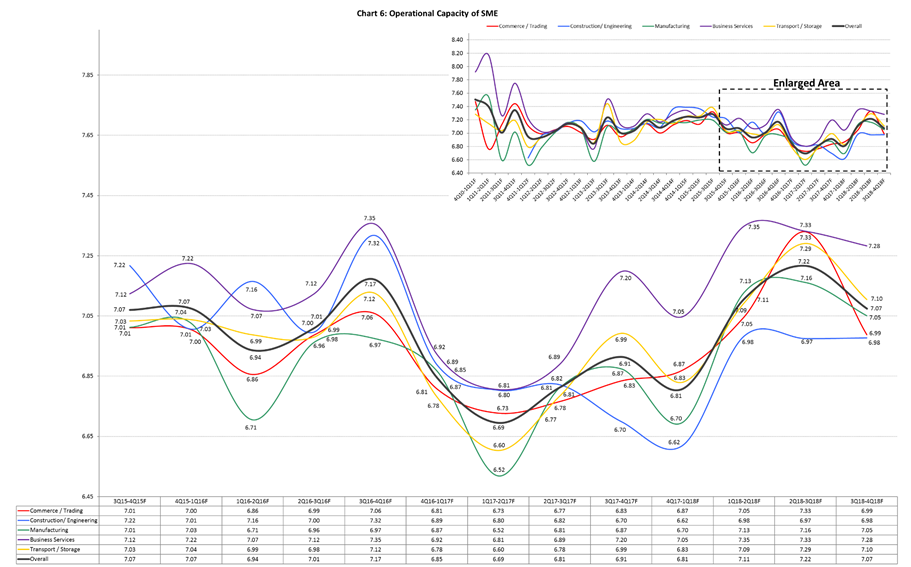

(F) Capacity Utilisation Expectations

(G) Access To Financing Expectations

ABOUT THE SINGAPORE BUSINESS FEDERATION (新加坡工商联合总会)

As the apex business chamber, the Singapore Business Federation (SBF) champions the interests of the business community in Singapore, in trade, investment and industrial relations. Nationally, SBF acts as the bridge between the government and businesses in Singapore to create a conducive business environment. Internationally, SBF represents the business community in bilateral, regional and multilateral fora for the purpose of trade expansion and business networking. For more information, please visit our website: www.sbf.org.sg

ABOUT DP INFORMATION GROUP

DP Information Group (DP Info) is Singapore’s leading provider of information, analysis and intelligence on the Singapore corporate sector. With an unparalleled database on the performance of local companies and access to the world’s best analytical services, DP Info uncovers the meaning and significance in data and gives its customers the knowledge they need to make better business decisions.

Part of Experian, the world’s leading global information services company, DP Info offers a range of powerful tools for assessing the credit worthiness and financial health of both companies and individuals. DP Info’s key services include:

- QuestNet – An online information portal used by Singapore’s leading financial institutions and law firms

- DP Credit Ratings – a proprietary credit rating model that reliably predicts the probability of company default

- DP SME Commercial Credit Bureau – a member-based platform where the payment records of each members’ clients and suppliers are shared

- SME Advisory Bureau – Singapore’s one-stop business advisory centre for entrepreneurs and business owners

- DP Credit Bureau – which analyses the credit records of millions of Singaporeans to assist financial institutions make lending decisions

- The Singapore 1000 Family of Awards – Singapore’s most prestigious definitive corporate awards, honouring the nation’s best performing companies

For more information, visit www.dpgroup.com.sg

ABOUT EXPERIAN

Experian is the world’s leading global information services company. During life’s big moments – from buying a home or a car, to sending a child to college, to growing a business by connecting with new customers – we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organisations to prevent identity fraud and crime.

We have 16,500 people operating across 39 countries and every day we’re investing in new technologies, talented people and innovation to help all our clients maximise every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.