Demands for faster payment lead to a drop in delinquent debts

SINGAPORE, 07 December 2017: Credit terms between SMEs and their customers continued to tighten in the third quarter of 2016, resulting in a drop in the number of delinquent debts.

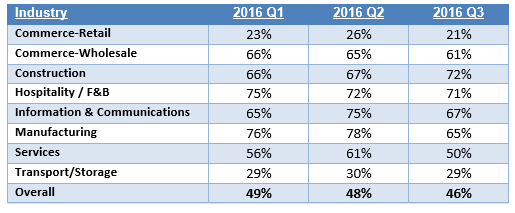

The percentage of debt unpaid after falling due has dropped to 46 per cent in Q3 2016, down from 48 per cent in Q2 2016 and 49 per cent in Q1 2016, according to research released today by DP Information Group (DP Info). DP Info is part of the Experian Group of companies and is Singapore’s leading provider of business and credit information services.

Table 1: Percentage of debt that is > 1 day delinquent

The steady drop in delinquent debts during the last six months is a result of SMEs demanding faster payment from their customers when agreeing to do business on credit.

The manufacturing industry has seen the most significant drop in companies with delinquent debtors – from 76 per cent in Q1 2016 to 65 per cent this quarter.

The Commerce-Retail sector has the lowest percentage of delinquent debts with only 21 per cent unpaid this quarter. This reflects a policy of many companies to demand prompt payment from retailers and to vigorously pursue money owed to them by retailers.

The SME payment data is consistent with the findings of the 2016 SME Development Survey, released earlier this month by DP Info. According to this survey, 34 per cent of SMEs said tighter access to supplier credit was an issue for them.

The tighter credit conditions are having an impact on the cash flow of companies. Cash flow problems are now the top business concern of seven per cent of SMEs – a doubling since last year when it was an issue for just three per cent of SMEs.

Mr Nick Boyle, Managing Director SEA & Emerging Markets of Experian, said tighter credit terms can lead to cash flow problems for SMEs.

“When a company has its credit terms tightened, the normal reaction is for that business to do the same to its debtors. As a result, the availability of credit may contract across the entire SME community, greatly impacting the number of business transactions.”

“A reduction in trade credit access can impact the cash flow of a business operation, and companies will find it hard to achieve growth without sufficient liquidity.”

“For the last two quarters the trend has seen SMEs having to place larger deposits on any purchase of goods or services as well as accepting a shorter period for the settlement of a debt.”

“We are also seeing greater pre-emptive action by SMEs to avoid being landed with bad debts. This includes more frequent credit checks and the sharing of payment intelligence between SMEs through the DP SME Commercial Credit Bureau,” Mr Boyle said.

Days Turned Cash (DTC) National Average

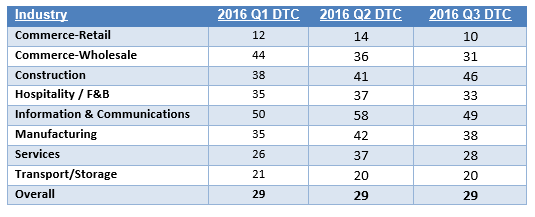

Singapore companies took an average of 29 days to pay their bills after the debt had become due in the third quarter of 2016. The Days Turned Cash (DTC) National Average has been at 29 days for each of the three quarters this year.

Table 2: Days Turned Cash National Average

While the overall average is unchanged, there have been notable changes in payment patterns across different industries.

Retail companies are paying their bills after just 10 days, indicating the very short credit terms many of them are being offered by suppliers.

Construction companies took five days longer to settle their bills this quarter, continuing the slower payment behaviour identified in the last quarter. Given the slowdown in private projects, this change in payment behaviour may be a sign of challenging times ahead for the construction sector.