Payment problems leading to cash flow concerns

SINGAPORE, 20 November 2017 – SMEs are adjusting their business models and improving their productivity by investing in technology and streamlining their processes, causing their concern about manpower issues to ease.

This is the key finding of the 2017 SME Development (SMED) Survey conducted by business intelligence and credit analytics company DP Information Group (DP Info), part of the Experian Group. The survey is the definitive research on Singapore’s SME community, with 2,522 SMEs taking part.

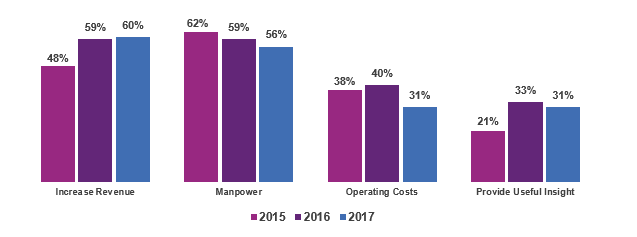

This year the proportion of SMEs experiencing difficulties with manpower costs fell to 70 per cent – below the level it was when the foreign labour restrictions were introduced in 2012. Concerns about manpower costs jumped from 72 per cent in 2012 to 85 per cent in 2013 and has declined every year since. This indicates SMEs are adjusting to the changes in the labour market by modifying their business models and making productivity improvements.

Chart 1: SMEs facing difficulties with manpower costs (%)

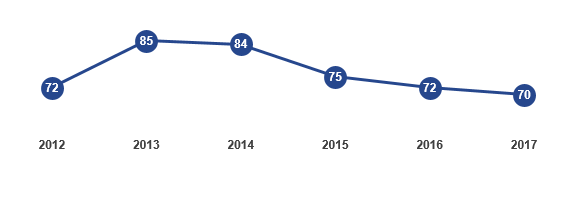

There has also been a decline in proportion of SMEs having difficulties hiring the staff they need, from 49 per cent in 2014 to 26 per cent in 2017.

Chart 2: SMEs facing difficulties hiring staff (%)

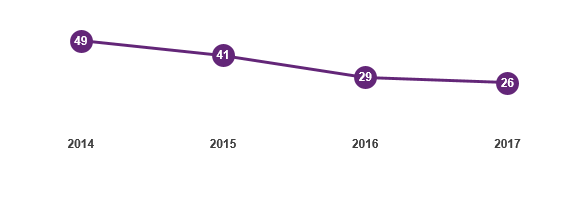

The percentage of SMEs whose main cost management strategy was to raise productivity fell from 42 per cent in 2016 to 29 per cent this year. As manpower and hiring concerns ease, the focus of SMEs is shifting towards revenue generation and growth strategies.

Chart 3: Raising Productivity Top Cost Strategy (%)

Mr Dev Dhiman, Managing Director, South East Asia & Emerging Markets for Experian said the adjustments SMEs are making in response to the changes in the labour market appear to be working.

“We are seeing a new phase in the development of Singapore SMEs where their focus is shifting away from surviving the restriction on foreign labour, towards winning market share and growing their businesses.”

“Manpower costs and hiring difficulties have been the big issues for SMEs during the last five years. Foreign labour restrictions required SMEs to find more sustainable ways of doing business through productivity improvements and investing in technology. Singapore SMEs have shown themselves to be resilient and agile enough to respond to the changes imposed on them.”

“Keeping costs down will always be a priority for SMEs and for most there is no greater cost than manpower. The cost of manpower remains a concern, but its relative prominence is now lower compared to other issues such as rent and material prices.”

“As manpower and productivity issues become less consuming for SME managers, they are able to focus on revenue strategies to drive growth such as raising customer service, improving marketing efforts and strengthening brand loyalty,” Mr Dhiman said.

SMEs TARGETING GROWTH DURING NEXT 12 MONTHS

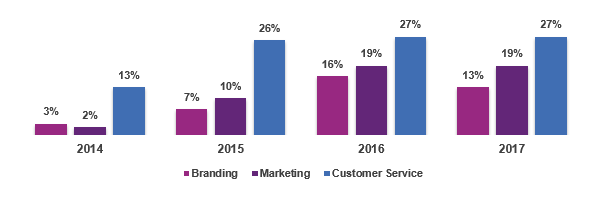

The businesses strategies SMEs intend to pursue in the next 12 months are primarily focused on growing their businesses. There is an increased emphasis on marketing and branding, both of which are designed to expand the SMEs existing client base as well as generate increased loyalty and patronage from existing customers.

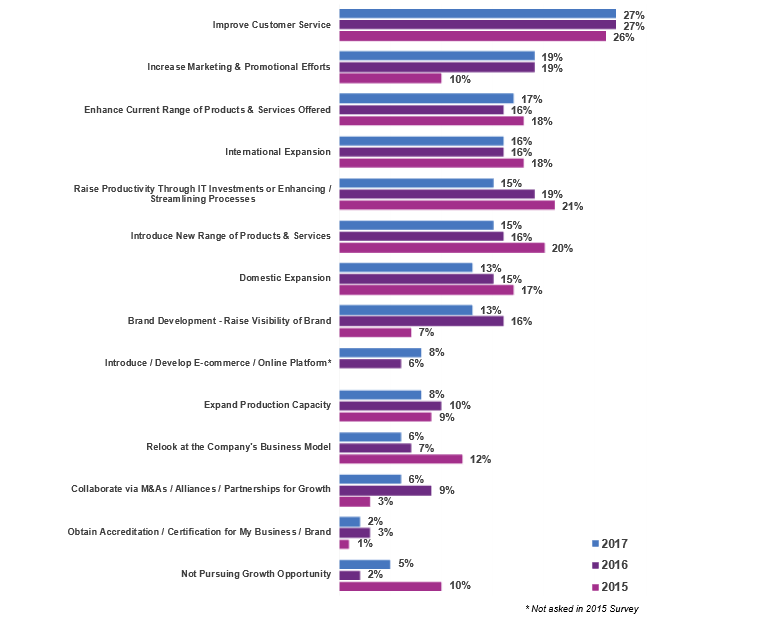

Chart 4: SME Business Strategies in the Next 12 Months

Raising customer service is the most popular strategy for the coming year with 27 per cent planning to make improvements to this aspect of their operations. This shows SMEs are becoming increasingly customer centric and moving away from the more inward-looking tactics such as cost suppression.

Nineteen per cent of SMEs plan to drive sales through increased marketing efforts, up from just two per cent three years ago, making this the second most popular business strategy among SMEs. At the same time, the percentage of SMEs focusing on brand visibility has increased to 13 per cent this year compared to three percent in 2014.

Chart 5: Customer-focused strategies on the rise

The percentage of SMEs intending to raise productivity in the coming year has declined each of the last two years, from 21 per cent in 2015 to 15 per cent this year.

PAYMENT PROBLEMS CAUSE CASH FLOW CONCERNS

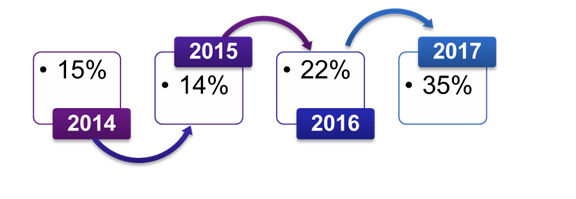

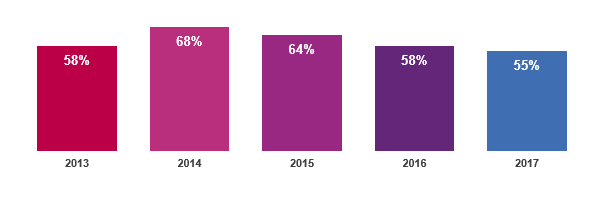

More than a third (35 per cent) of SMEs have finance-related issues, a sizable 13 per cent jump in the last 12 months and the highest percentage since the survey began tracking the issue in 2011. The number of SMEs with finance-related issues has more than doubled since 2014.

Chart 6: % of SMEs with Finance-related issues

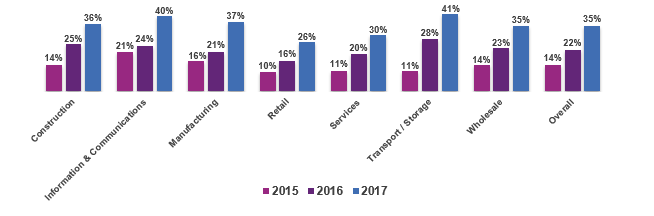

The proportion of SMEs with finance-related issues increased across all sectors, with notable jumps in Information & Communications (up 16 per cent) and Manufacturing (up 16 per cent).

Chart 7: Companies Facing Finance-related Issues by Business Sector

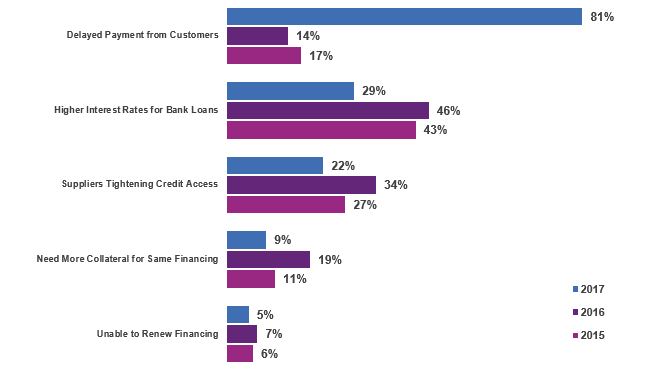

Among the 35 per cent of SMEs with finance-related issues, the proportion experiencing delays in payments from customers skyrocketed from 14 per cent in 2016 to 81 per cent this year. Customer payment problems have overtaken high interest rates as the dominant finance-related issue confronting SMEs.

The gap between supplier terms and the credit given to customers, along with slower customer payments, is increasing the risk of cash flow and working capital problems. Cash flow constraints have the potential to hold back the growth strategies SMEs intend to pursue during the next 12 months. As more customers delay their payment, there is a concern it will have a domino effect causing more SMEs to experience cash flow shortages which in turn will lead to them delaying payment to their customers.

Chart 8: Finance-related Issues affecting SMEs

TECHNOLOGY SPEND SHIFTS FROM PRODUCTIVITY TO REVENUE CREATION

More than half of SMEs (55 per cent) made fresh investments in technology and innovation in the last 12 months. The reason 10 per cent of SMEs did not invest more was because they had already strengthened their in-house technology capabilities prior to the last 12 months.

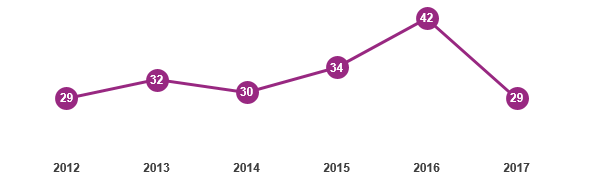

Investing in technology has been a common response of SMEs to the tighter labour situation, so the moderation in investment indicates this is no longer as pressing as it was a few years ago. This year 56 per cent of SMEs obtained manpower efficiencies from their technology use, down from 62 per cent two years ago.

Chart 9: Plan to Strengthen In-House Technology/Innovation Capabilities

Instead, the biggest benefit from technology is increased revenue growth through applications such as e-commerce platforms, data-mining of customers and enhanced sales functions. This year 60 per cent of SMEs said they are getting revenue gains from technology compared to 48 per cent in 2015.

Chart 10: Areas of Business Opportunities Gained from Using Infocomm Technology