- Digitalisation, manpower optimisation, and process innovation are the key strategies being adopted to drive greater productivity and sustain growth

- Challenging business environment expected, with SMEs anticipating lower turnover and facing finance related challenges

- Calls for more assistance to help strengthen financial capability and workforce & training development; with SMEs looking to Industry Transformation Maps for assistance and direction

SINGAPORE, 05 December 2018 – Singapore’s small and medium enterprises (SMEs) will be leveraging technology and looking towards manpower and process improvements to drive productivity and sustain growth in the midst of challenges that are expected to persist in the business environment.

This is the key finding of the 2018 SME Development (SMED) Survey conducted by business intelligence and credit analytics company DP Information Group (DP Info), part of the Experian Group. The survey, which started in 2003 and is currently in its 16th edition, is the definitive research on Singapore’s SME community, with 2,557 SMEs taking part this year.

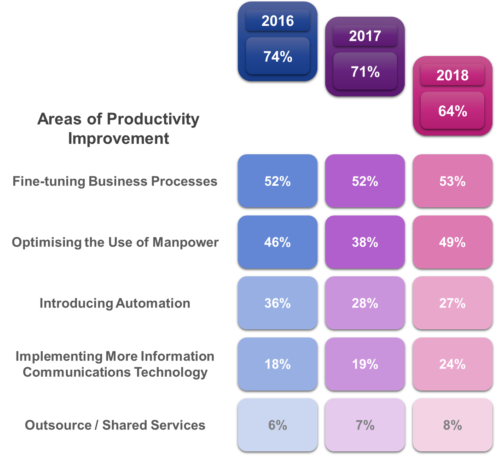

The 2018 survey showed that two in three SMEs (64%) are intent on driving productivity, focusing on Fine-Tuning Business Practices (53%), Optimising the Use of Manpower (49%), Introducing Automation (27%) and Implementing More Information Communications Technology, or ICT (24%).

Figure 1: Areas of Productivity Improvement for SMEs

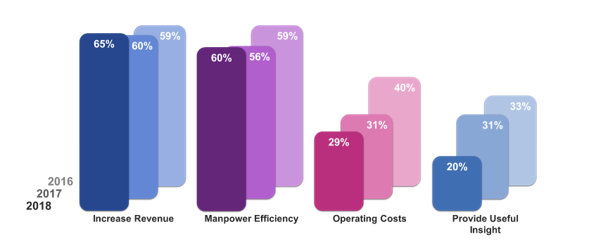

Specifically, SMEs in Singapore see ICT as a key enabler of business transformation, recognising its role in the creation of business opportunities such as Increase Revenue (65%), improve Manpower Efficiency (60%), manage Operating Costs (29%) and Provide Useful Insights (20%).

Figure 2: Business Opportunities from ICT Adoption

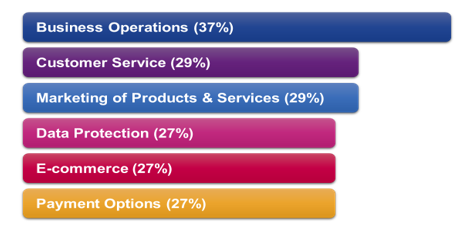

Seven out of 10 SMEs (70%) intend to embark on a digital transformation journey, with a core focus in Business Operations (37%), Customer Service (29%) and Marketing of Products & Services (29%). In fact, a third of respondents (31%) have already adopted at least one digital solution, mostly in the areas of Digital Ordering & Payment Systems (11%), E-commerce (10%) and Workforce Management & Reporting (10%).

Figure 3: Digital Transformation Adoption Areas

Figure 4: Digital Solution Adoption Areas

Mr James Gothard, General Manager, Credit Services & Strategy SEA of Experian, said: “Singapore SMEs are responding to business headwinds proactively and are looking at transforming their business as a whole. They see a need to increase productivity with changes to their business and manpower processes, and they see ICT as a key enabler in these efforts.”

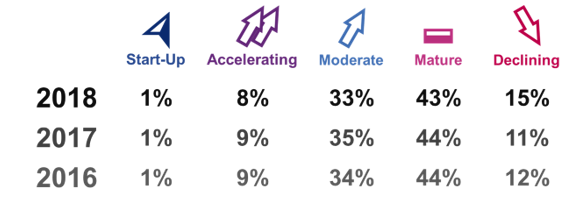

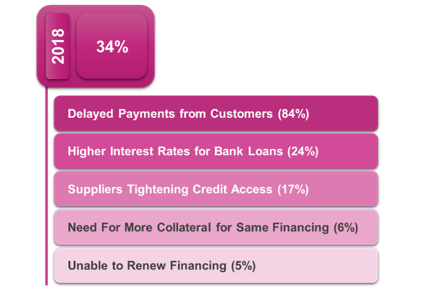

Cashflow concerns continue to be a key issue for Singapore SMEs. This year, 15% of SMEs expect turnover growth to decline in 2018, an increase compared to 11% in 2017. A third of SMEs (34%) are noted to be facing external finance-related challenges, of which their top concern being Delayed Payments from Customers (84%).

Figure 5: SMEs Stages of Development

Figure 6: Finance-related Issues Faced by SMEs

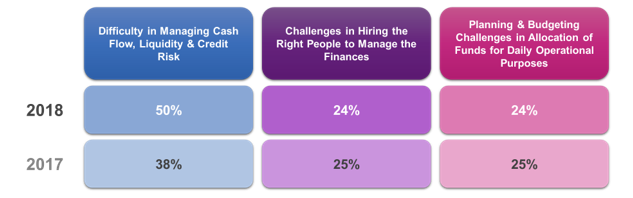

Additionally, more than two in five (44%) SMEs are facing internal difficulties managing their finances. The key concern among these SMEs are Managing Cash Flow, Liquidity & Credit Risk (50%; an increase from 38% in 2017), followed by Challenges in Hiring the Right People to Manage Finances (24%; 25% in 2017) and Planning & Budgeting Challenges in Allocation of Funds for Daily Operational Purposes (24%; 25% in 2017).

Figure 7: Challenges Faced by SMEs in Managing Finances

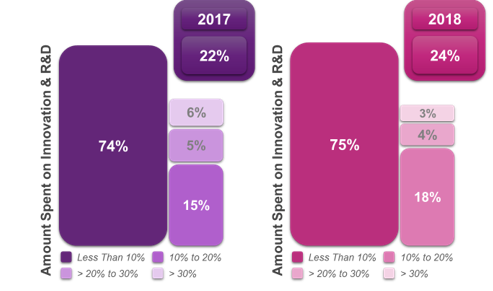

These concerns may have led to hesitation around investing in their business transformation. While one in four SMEs (24%) have invested in innovation and R&D this year, a 2% increase over the previous year, the investments amounted to less than 10% of their sales for the majority of these companies (75%).

Figure 8: SME Spending on Innovation and R&D

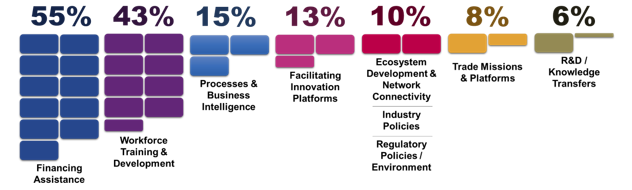

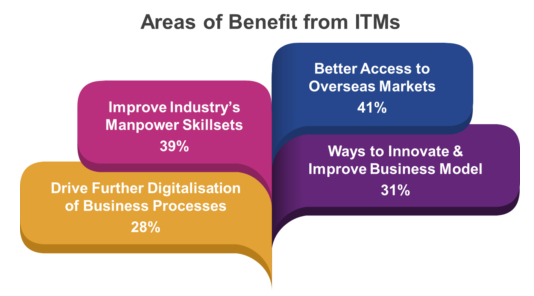

To overcome such rising concerns, SMEs are looking to future-proof their business and are receptive to government support in the key areas of Financing Assistance (55%) and Workforce & Training Development (43%). They are also intending to tap on Industry Transformation Map (ITMs) programmes for assistance and direction, especially in the areas of Better Access to Overseas Markets (41%), Improve Industry’s Manpower Skillsets (39%), Ways to Innovate & Improve Business Model (31%) and to Drive Further Digitalisation of Business Processes (28%).

Figure 9: Areas of Government Efforts for Future Readiness

Figure 10: Areas of Benefits from ITM Adoption

Mr Gothard added, ““The success of the SME community is key to this country and its economic transformation as they make up 99 per cent of all enterprises and employs some 65 per cent of its workforce. However, this year’s survey shows that SMEs continue to face finance-related concerns such as managing cash flow and delays in payment, which may affect the execution and funding of their transformation journey.

“Though SMEs have shared that they are facing tough and challenging times on multiple fronts, it is heartening to see that our SMEs are proactively driving productivity improvements and business transformation, and heeding calls by the government and industry leaders to take advantage of Singapore’s digital economy push,” said Mr Gothard.

Mr Mervyn Koh, Managing Director and Country Head of Business Banking Singapore, United Overseas Bank (UOB), said, “From UOB’s first-hand experience of working with SMEs, we know that while many of them are keen to digitalise their business for better performance, they also seek more guidance and assistance on the implementation of the right digital solution. This is in line with the findings of the SME Development Survey. To assist SMEs with their business transformation, we remain committed to helping them deepen their digital capabilities. For example, we help SMEs implement digital solutions such as UOB BizSmart into their business seamlessly so that they can manage their key operating processes digitally for improved efficiency.”