- Uncertainties stemming from the COVID-19 outbreak and restrictions to slow the virus’ spread have depressed overall expectations of Singapore’s SMEs for 4Q20 – 1Q21F, with Singapore entering its deepest recession on record.

- The steepest fall in business sentiments was registered by Construction / Engineering, likely a result of additional costs and restrictions involved in restarting construction projects.

- Despite registering the lowest sentiments among all sectors surveyed, SMEs in Retail / F&B appear to be less pessimistic, encouraged by the reopening of physical stores and eateries.

- Most SMEs appear to be adopting a wait-and-see approach, with aspirations pertaining to growth and expansion remaining neutral.

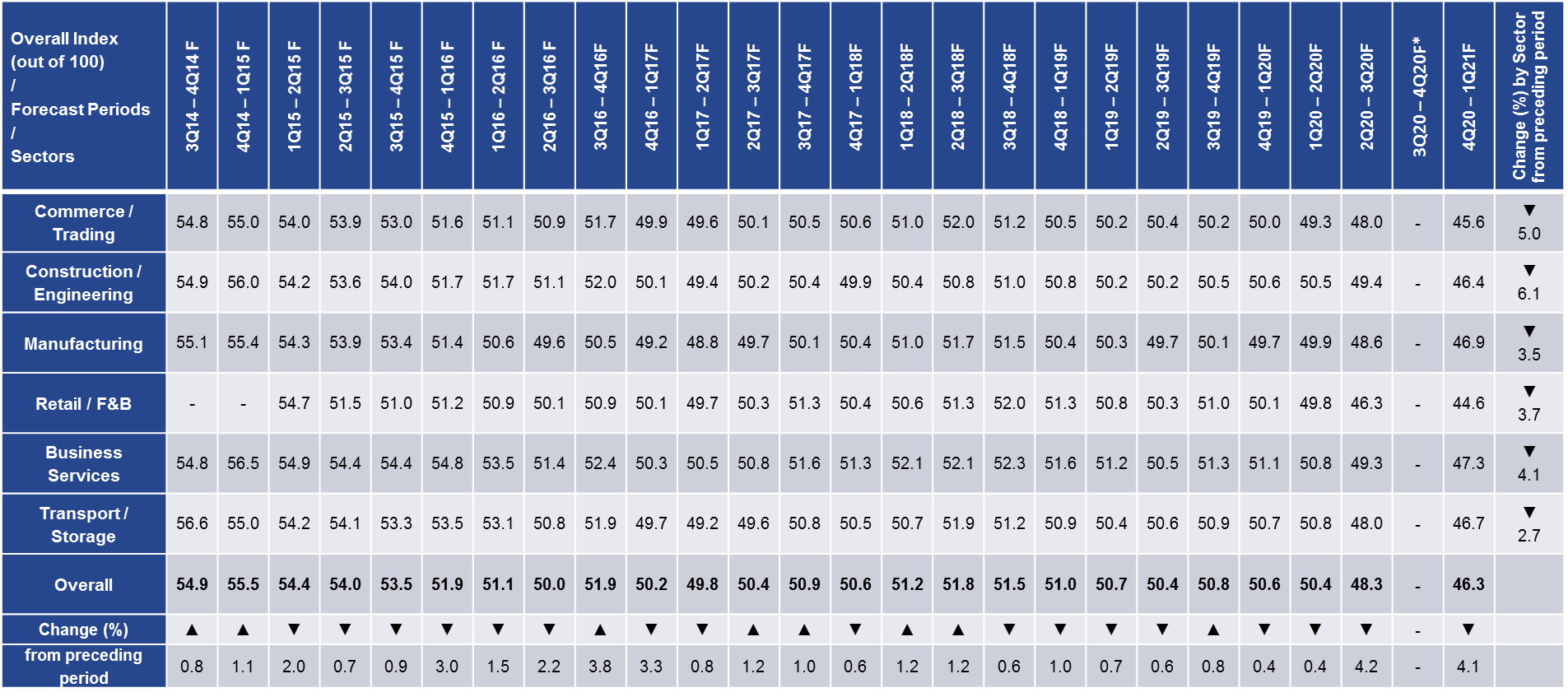

SINGAPORE, 25 September 2020 – The COVID-19 pandemic has constrained global growth and slowed economic activities around the world. The SBF-Experian SME Index for 4Q20 – 1Q21F registered an overall reading of 46.3, the lowest reading since the inception of the SME Index (“the Index”) in 2009.

Restrictions enacted worldwide to stem the spread of COVID-19 have led to steep declines in key global markets. The GDP of the United States contracted by a record 32.9% in 2Q20, while China has decided against setting a GDP target for the first time in decades, highlighting the extent of the uncertainties dominating the global economy.

The Asia-Pacific region’s economy is expected to contract by 3.7% in 2020. Singapore saw its economy contract by 13.2% year-on-year in 2Q20, prompting the Ministry of Trade and Industry (MTI) to downgrade its GDP growth forecast for 2020 to -7% to -5%. The weaker outlook was attributed to a depressed external economic environment, continued closure of international borders, and the delayed resumption of activities for sectors reliant on foreign workers.

The Index – a joint initiative of the Singapore Business Federation (SBF) and Experian – measures the business sentiment of SMEs in Singapore for the next six months (October 2020 to March 2021). The Index comprises inputs from SMEs on their expectations in seven key areas – Turnover, Profitability, Business Expansion, Capital Investment, Hiring, Capacity Utilisation, and Access to Financing. This Index is based on a survey of more than 2,100 SMEs across six sectors – ‘Commerce / Trading’, ‘Construction / Engineering’, ‘Manufacturing’, ‘Retail / F&B’, ‘Business Services’, and ‘Transport / Storage’. The survey was conducted between 13 July to 21 August 2020. With most SMEs experiencing difficulties assessing the impact of COVID-19 during the circuit breaker period, no survey was conducted for the period 3Q20 – 4Q20F.

Outlook for 4Q20 – 1Q21F (October 2020 to March 2021)

[Note: Survey Period: 13/07/2020 to 21/08/2020]

*Note: 3Q20-4Q20F data collection paused due to Circuit Breaker

Uncertainties stemming from the pandemic and restrictions put in place to slow the spread of COVID-19 have dampened the overall outlook of Singapore’s SMEs for 4Q20 – 1Q21F. SMEs within the six sectors surveyed have all registered readings below 50, signalling contractionary sentiments.

The Construction / Engineering sector registered the most significant decrease in sentiment (down 6.1%), likely attributed to extended dormitory quarantines and additional costs incurred from prolonging project timelines. With business operations severely disrupted since the onset of the virus and with restrictions set to continue for the foreseeable future, SMEs in Retail / F&B were the least optimistic (44.6).

Overall sentiments declined for four out of seven indicators tracked. Decreases were registered in Turnover Expectations (from 4.47 to 3.67) and Profitability Expectations (from 4.39 to 3.57), setting a new low for both indicators on record and possibly a reflection of how SMEs are bracing for the recession.

Declines were also observed for Capacity Utilisation (from 6.58 to 5.77) and Hiring Expectations (from 5.18 to 5.08), while Business Expansion Expectations (5.08) and Capital Investment Expectations (5.03) were unchanged from the previous survey. These readings suggest that many SMEs may be adopting a wait-and-see approach, holding back on expansion plans until the outbreak has stabilised both locally and globally.

Financial Impact of COVID-19 on SMEs

In response to the pandemic, the Singapore government has dedicated close to S$100 billion to tide Singapore through the COVID-19 crisis, helping firms mitigate the impact of the flagging economy and ailing domestic demand. In spite of these support measures, SMEs across all sectors are bracing for a deep contraction in turnover in the next six months. Turnover Expectations registered an overall decline of 17.90% to 3.67, setting a new low for the indicator. With the exception of Retail/F&B (down 2.74% to 3.91), all other sectors saw significant double-digit percentage declines in Turnover Expectations, with the sharpest fall registered among Commerce / Trading SMEs (down 27.89% to 3.18).

This also contributed to SMEs registering the lowest reading for Profitability Expectations (down 18.68% to 3.57) on record. The Construction / Engineering sector registered the steepest decline (down 29.57% to 3.31), while SMEs in Commerce / Trading saw the lowest reading at 3.13 (down 28.38%). Retail / F&B was the only sector that registered a marginal rise (up 0.76% to 3.96) in Profitability Expectations.

SMEs Remain Cautious about Growth and Expansion

Continuing the trend observed during the initial outbreak of COVID-19, SMEs across most sectors remain cautious, scaling back growth and expansion plans. Muted readings across Business Expansion Expectations and Capital Investment Expectations suggest that SMEs may be adopting a wait-and-see approach amid the ongoing economic uncertainty.

Business Expansion Expectations remain unchanged (5.08) since the last survey 6 months ago, the lowest in the history of the Index. SMEs in the Commerce / Trading sector continue to face pressure from the global economy, bearing the brunt of the COVID-19 downturn and falling 3.19% to 4.85. Notably, this is the first instance since the inception of the Index where the reading is below 5. This could possibly indicate that businesses in this sector are relooking at their business strategies and consolidating their efforts to preserve their core capabilities. The Commerce / Trading sector could be refocusing efforts to address supply chain disruptions to stay afloat.

Capital Investment Expectations also remained unchanged (5.03) from the previous survey. This suggests that SMEs are likely more focused on resolving immediate day-to-day challenges, leaving investment and expansion opportunities on the backburner to maximise cashflow.

Slow Restart for Construction / Engineering

While Construction / Engineering posted robust performance throughout much of 2019 due to a healthy pipeline of public sector projects, SMEs in the sector registered significant dives in Turnover Expectations (down 25.42% to 3.55) and Profitability Expectations (down 29.57% to 3.31) despite some work having resumed for construction projects. This is likely due to additional compliance costs unique to the sector to ensure works resume safely in compliance with COVID-Safe Worksite requirements.

The additional financial commitments needed to restart operations have also led to firms in the sector treading cautiously. Capital Investment Expectations saw a marginal decrease (down 1.79% to 4.95) while Hiring Expectations also registered a drop (down 4.22% to 4.99).

Cautious Optimism Observed Among Retail / F&B

The Retail / F&B sector was the least optimistic among the six sectors. However, they appear to be benefiting from the gradual recovery of domestic demand with the easing of COVID-19 measures, bucking the overall decline observed in the rest of the sectors surveyed.

Although expectations remain contractionary, Turnover Expectations and Profitability Expectations for SMEs in Retail / F&B have bottomed out. Business Expansion Expectations for Retail / F&B turned positive (up 4.20% to 5.21), the highest reading among all sectors surveyed. This sector also registered a minor improvement for Capital Investment Expectations (up 0.60% to 5.03) and Hiring Expectations (up 0.20% to 5.09). These suggest that Retail / F&B SMEs seem to harbour hope that the sector will continue to improve as retail sales have recovered sharply after the circuit breaker restrictions were lifted.

“Despite the gradual easing of COVID-19 restrictions across major Asian economies, the threat posed by the virus remains a key challenge for SMEs in Singapore, with steep declines of economic activity being observed. Despite the easing of Circuit Breaker measures providing some respite to Retail / F&B SMEs, uncertainty appears to still prevail in the regional economic climate. This has restricted the overall ability of firms to properly plan for the future, limiting growth and expansion aspirations, and has been most apparent for external facing sectors such as Commerce / Trading that have experienced a sustained slump,” said James Gothard, General Manager, Credit Services & Strategy, Southeast Asia, Experian.

“With the Singapore economy expected to enter its deepest recession on record, the slew of supporting initiatives from the Singapore government will be important to tide SMEs through this challenging period. Beyond immediate monetary relief for day-to-day operations, the onus will also be on SMEs to effectively utilise government supporting measures to boost competitiveness through means such as digitalisation. This will be vital in allowing them to more effectively capitalise on opportunities that arise as Singapore embarks on its post-pandemic recovery plans,” he added.

Mr Ho Meng Kit, CEO of SBF, said, “As COVID-19 continues to adversely impact the global economy, and with no immediate relief in sight, business sentiments have remained low for the next six months. Some safe resumption of business travel and a calibrated reopening of sectors will further boost economic activities in Singapore. This will hopefully raise sentiments of businesses going forward. For example, with more employees allowed to return to their workplaces, F&B outlets in the CBD area should start to do better. The on-going uncertainties have resulted in SMEs putting on hold their investment and expansion plans. There is no return to the pre-COVID situation as the post-COVID world is going to be very different. We therefore urge companies to maximise the support from the Government, reinvent themselves and strategically position their businesses for the eventual recovery in a post-COVID-19 world.”