9 May, 2016 [Singapore]: Singapore’s retail companies are experiencing a significant tightening of their cash flow positions as creditors take steps to protect themselves against possible defaults.

An analysis of corporate payment behaviour by DP Information Group (DP Info) shows retail companies take the fewest days to settle a bill after it is due. While this may appear to indicate financial strength, in reality it shows creditors are demanding prompt payment from retail companies.

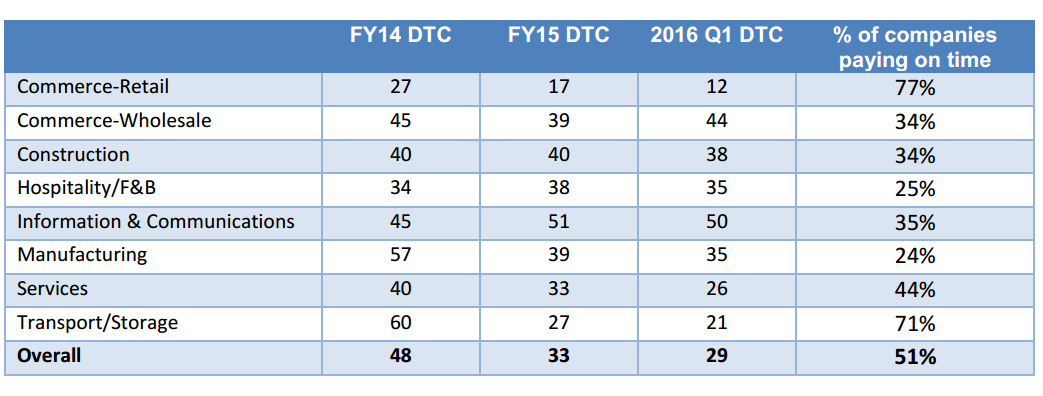

According to the Days Turned Cash (DTC) National Average – a measure of the days a company takes to pay a creditor once a debt is due – retail SMEs took just 12 extra days to settle their accounts in Q1 2016. This compares to the DTC National Average of 29 days, calculated across eight industries. And a high 77 per cent of retail companies settled their debts on time, making them the most prompt payers of any industry.

Mr Lincoln Teo, Chief Operating Officer of DP Info said the tight payment times are an indication of the concern other companies have when providing credit to retail companies.

“Some companies are telling us that it is now the norm to demand prompt payment from retail companies. It is also their policy to vigorously pursue money owed by retailers.”

“Several unfavourable factors are impacting the retail sector including higher wages, foreign labour restrictions, increased rents and increased competition. This has made companies more cautious when extending credit terms to a retail company.”

“This has a negative effect on the cash flow of retail companies because they are unable to tap on suppliers’ credit – a common short-term financing approach used to ease their cash flow.”

“The tough conditions in the retail sector are confirmed by other research published by DP Info. According to the quarterly SBF-DP SME Index, the level of optimism of retail SME companies has been declining since the start of 2015 to the point where retail SMEs do not expect any significant growth in their businesses during the next six months1,” Mr Teo said.

The way forward for retail SMEs

Mr Teo said the quicker retail companies responded to the tightening of credit and cash flow in their industry, the more likely they were to survive.

Strategies which retail SMEs could use to avert a cash flow crisis include:

Rethinking business approach – A review of the current business approach should be at the top of the agenda for retail companies. Many will need to change to become more competitive, such as reducing their reliance on manpower and embracing online trading.

Reducing overheads – Every business practice and relationship a company has needs to be reviewed to see if it can be done more efficiently. While some costs are fixed, there are still options for savings such as finding cheaper warehousing or negotiating better rates from couriers.

Assess credit needs carefully – If a company needs an overdraft or other forms of financing to see it through a tough period, the borrower must understand its capacity, cash flow, capital and economic conditions before getting more credit.

Review your purchasing plan – For some businesses it makes sense to reduce their unit purchased costs by buying in bulk once or twice a year. It can make more sense to make smaller and more frequent purchases so that less of the company’s money is tied up in payables and inventory.

Managing currency risks – As most retailers sell goods manufactured overseas, they are inevitably exposed to the risk of currency fluctuations. Retailers should explore financial products such as hedging with the banks to see if currency risks can be better managed.

Join a credit bureau – An SME credit bureau (such as the DP SME Commercial Credit Bureau) is a way for SMEs to stay ahead of potential payment problems. As all members of the bureau share their payment data with a central authority (the bureau), when a party is late with a payment then all other companies are alerted. This means member companies can take steps to get their money before the situation becomes unrecoverable.

Days Turned Cash (DTC) National Average

Singapore companies took an average of 29 days to pay their bills after the debt had fallen due.

The Hospitality/F&B sector is another industry where payment behaviour indicates there may be problems. According to DP Info’s analysis, only one in four companies in this sector settled their bills on time. Hospitality/F&B companies took an additional 35 days to settle an account once it was due, well above the DTC National average of 29.