8 March 2018 [Singapore] – Singapore’s top 1000 companies enjoyed their most successful year ever with a double-digit increase taking their combined profits to a record high.

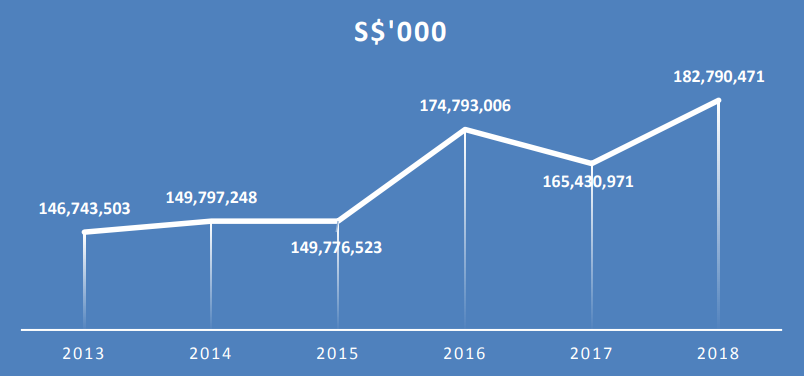

The Singapore 1000 (S1000) companies generated a combined profit of S$182.8 billion this year compared to S$165.4 billion in 2017, an increase of 10.5 per cent.

The S1000 ranks the largest 1,000 companies in Singapore by revenuei and is produced by DP Information Group (DP Info), part of Experian, and co-produced by EY. It is published together with the SME 1000 and Singapore International 100 (SI100) rankings. To create the rankings, DP Info uses its unique databases of the financial returns of more than 70,000 companies, including thousands which are voluntarily submitted and are unavailable through public sources.

FIGURE 1: Singapore 1000 Combined Profits 2013-2018

Between 2013 and 2018, the combined profits of the S1000 companies increased by S$36.0 billion. This equates to a five-year compounded annual growth rate of 4.5 per cent, with the bulk of the increase coming in the last three years.

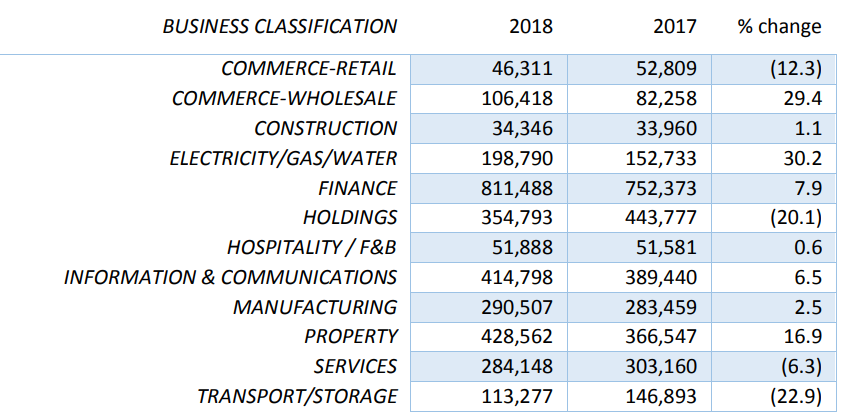

Finance companies were the most profitable, with each company recording an average profit of S$811.5 million, followed by the Property Sector with an average profit per company of S$428.6 million.

The Electricity/Gas/Water sector had the largest increase in average profits per company – a 30.2 per cent improvement to an average of S$198.8 million per company this year. The next largest increase was in the Commerce/Wholesale sector whose profit per company increased by 29.4 per cent to S$106.4 million.

FIGURE 2: Average Profits by Industry Sector (S$’000)

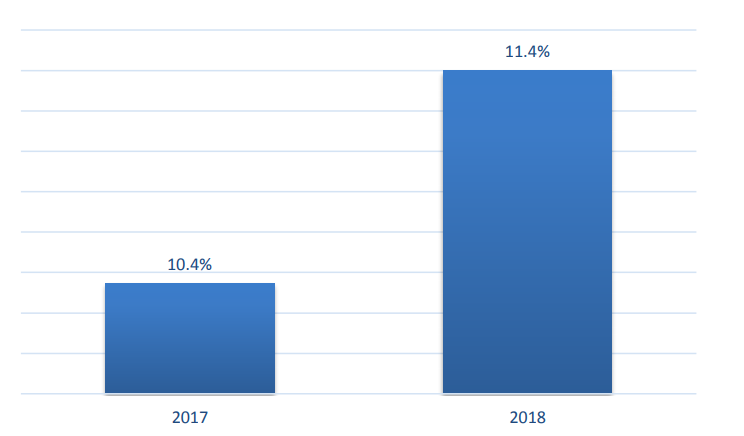

Combined turnover remained flat increasing by just 1.1 per cent to S$2.79 trillion in 2018, so the increase in profits is the result of improved margins, rather than increased sales volumes. Profit margins improved from 10.4 per cent in 2017 to 11.4 per cent in 2018.

FIGURE 3: S1000 Profit Margins

Mr James Gothard, General Manager, Credit Services & Strategy SEA of Experian said rising profits among Singapore’s top companies will have a flow on effect to the wider economy.

“Singapore’s top companies are doing what they do best – generating revenue and remaining profitable. We are seeing increased profits from companies in most industry sectors in Singapore, which is a sign of an improved business environment.”

“As large companies see their bottom-line improve, they are more likely to pursue growth strategies. This means further expansion into international markets, increased spending on wages and employment, as well as opportunities for smaller firms to supply their goods and services.”

“Having a strong and profitable corporate sector has always been an element of Singapore’s economic success. When companies are doing well, the rest of Singapore also does well,” Mr Gothard said.

SME 1000 PERFORMANCE

While the Singapore 1000 companies enjoyed a record year, it was a different story for the SME 1000 companies, which includes the largest mid-sized businesses in Singapore.

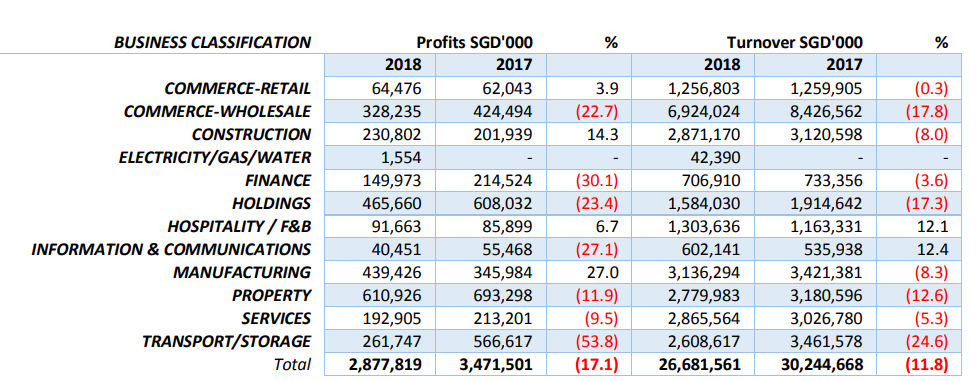

The combined turnover of the SME 1000 fell by 11.8 per cent from S$30.2 billion in 2017 to S$26.7 billion in 2018. Profits also declined during the ranking period, from a combined S$3.5 billion in 2017 to S$2.9 billion in 2018 – a drop of 17.1 per cent.

Transport/Storage SMEs fared the worst with a 24.6 percent decrease in combined turnover resulting in a 53.8 per cent drop in combined profits. The Commerce-Wholesale sector recorded a 17.8 percent drop in combined turnover and a 22.7 per cent decline in combined profits. The performance of both these sectors is linked to international trading conditions.

The Commerce/Retail, Construction and Manufacturing sectors achieved higher profits despite having lower turnover. These three sectors where among the most affected by changes to foreign labour policies. Their profitability gains are a sign they have lifted their efficiency either through cost savings or by productivity improvements.

SMEs in the Hospitality/F&B sector recorded a 12.1 per cent increase in combined turnover leading to a 6.7 per cent improvement in combined profits. The lower Singapore dollar during the ranking period helped attract more foreign visitors to Singapore, which drove up economic activity in this sector.

Commenting on the SME 1000 results, Mr Gothard said: “SMEs are emerging from a difficult period which is reflected in the SME 1000 results this year.”

“Many SMEs struggled against factors beyond their control including slow GDP growth, weak global trade and the need to invest in technology and productivity improvements in response to manpower restrictions.”

“One positive sign is the increased profits of industries affected by foreign labour policies, such as retail, construction and manufacturing. Restricted access to foreign labour has likely forced these companies to focus on productivity. They have now emerged as more competitive, efficient and profitable.”

“Hospitality and F&B SMEs are performing strongly, confirming Singapore’s attractiveness as a holiday destination with a unique food culture,” Mr Gothard said.

FIGURE 4: Performance of SME 1000

SINGAPORE INTERNATIONAL 100

The Singapore International 100 ranks companies by the available data on their overseas revenue. This year the total overseas revenue of the top 100 internationalised companies in Singapore fell 11.0 per cent to S$165.4 billion. This follows a 9.9 per cent drop in international revenue last year.

The decline in revenue reflects global trading conditions during the ranking period, which saw merchandised trade record its lowest volume growth since the financial crisis of 2008, as investment slumped in the US and China moved to increase its domestic consumption.

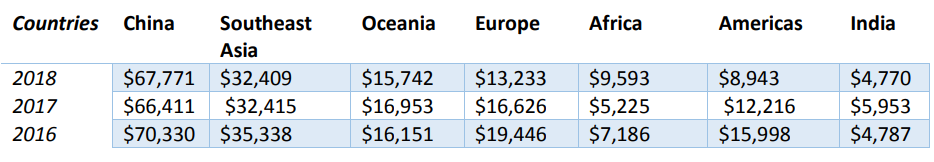

Sales from China increased by 2.0 per cent, while revenue from Southeast Asia, Europe, America, Oceania and India were all lower than in 2017. The region which has shown the fastest growth is Africa where the S1000 companies’ revenue has grown by 63.0 per cent in the last five years to S$9.6 billion and now accounts for 6.1 per cent of international revenue.

FIGURE 5: Revenue of Top 100 Internationalised Companies by Region (S$’million)

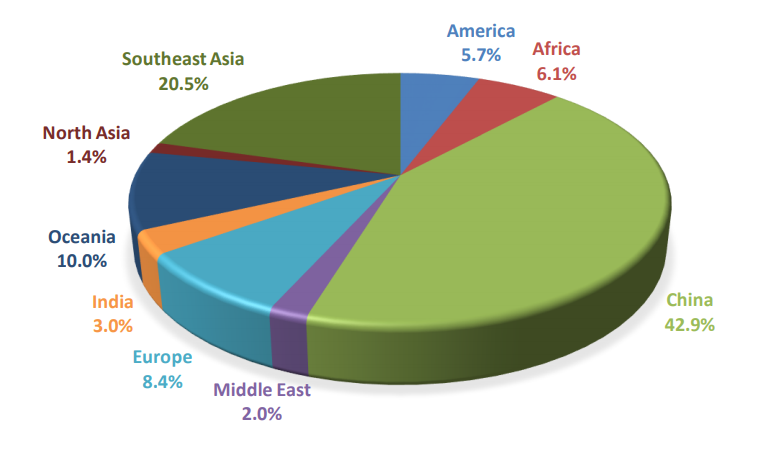

China dominates the international revenue of Singapore’s top 100 companies with 42.9 per cent of all sales during the ranking period. Southeast Asia’s revenue comes in at just under half of that of China, accounting for 20.5 per cent of international sales.

FIGURE 6: International revenue of the SI100 companies by source market

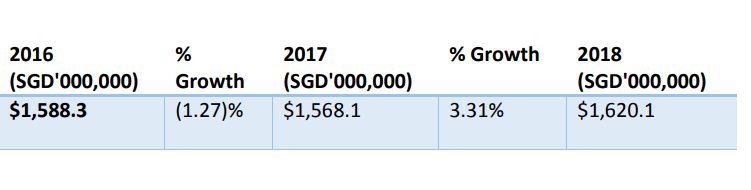

SINGAPORE INTERNATIONAL TOP 50 SMEs

The Singapore International Top 50 SMEs is a ranking based on the available data of the overseas revenue of SMEs. This year the total overseas revenue of the top 50 internationalised SMEs increased by 3.3 per cent to S$1.6 billion.

FIGURE 7: Aggregated Turnover of Top 50 Internationalised SMEs

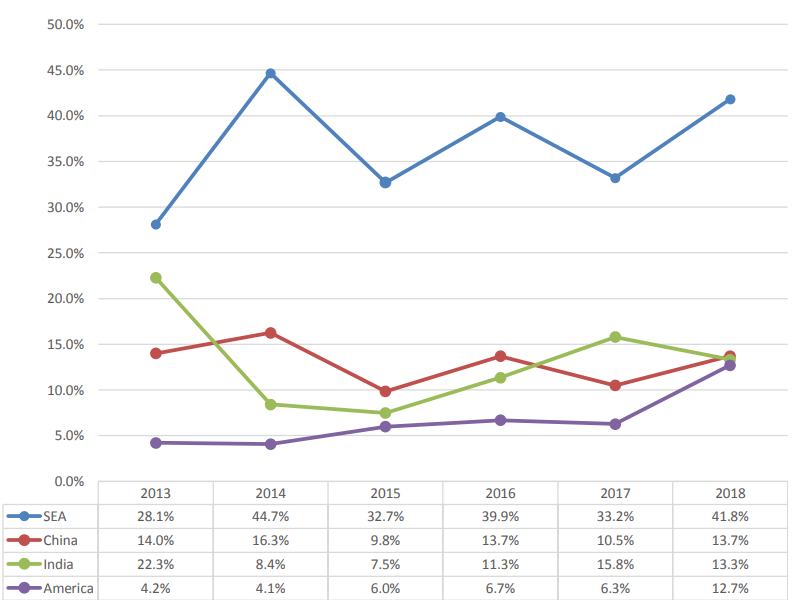

Southeast Asia was again the most important market for the 50 SMEs with the highest international revenue. This year 41.8 per cent of their revenue came from Southeast Asian countries – more than three times the revenue generated in China.

ASEAN countries consistently account for more than a third of the revenue of Singapore’s top 50 internationalised SMEs and DP Info’s data shows the region will continue to be the top revenue source throughout the rest of the year.

Commenting on the results, Mr Gothard said: “Singapore SMEs have become extremely adept at doing business in ASEAN countries. Geographical proximity as well as cultural familiarity means there are fewer barriers to trading goods and services among Singapore’s neighbouring countries.”

“We expect Southeast Asia to grow in prominence as a target market for SMEs as Singapore uses its position as ASEAN Chair to strengthen economic ties within the region and to boost regional business opportunities,” Mr Gothard said.

FIGURE 8: International revenue of the top 50 internationalised SMEs

ABOUT THE RANKINGS

The Singapore 1000, SME 1000 and Singapore International 100 are ranked and published by DP Information Group with EY as Co-Producer. It is supported by the Singapore Business Federation, IE Singapore, SPRING Singapore, ACRA and IMDA. Official Media Partners are The Business Times and Fortune Times. The Award Artisan is Royal Selangor.