Two thirds of SMEs do staff training but most spend less than $500 per employee a year

Finance and cash flow emerge as major new challenges

2 November, 2016 [SINGAPORE] – Most SMEs are investing in skills training for their workforce despite eight in 10 saying they are hindered in doing so.

This is one of the key findings of the 2016 SME Development (SMED) Survey conducted by DP Information Group (DP Info), Singapore’s leading provider of business intelligence and credit analytics. The SMED Survey is the definitive research on Singapore’s SME community, with 2,513 SMEs taking part.

The survey found 68 per cent of Singapore SMEs invested in manpower development programs to improve the skills of their workforce. Construction firms were the most likely to spend on skills training (88 per cent) followed by SMEs in the Infocomm sector (75 per cent). Wholesale (56 per cent) and Retail (62 per cent) were the least likely to spend on skills training.

Of the companies that do invest in skills training, 66 per cent spend up to $500 per employee per year, including 18 per cent that spend up to $100 per employee per year.

Table 1: Amount Spent on Training per Employee by Business Sector

According to the survey, 85 per cent of SMEs are hindered in their efforts to upgrade the skills of their workforce. Manufacturing companies face the most obstacles to skills development (90 per cent), while retail firms face the least (74 per cent).

Table 2: Faced Obstacles Hindering Participation in Manpower Development Initiatives

The main hindrance is committing their employees to training initiatives when their workforce is too lean, an obstacle faced by 50 per cent of SMEs. Another 38 per cent have other priorities they need to focus their resources on.

Table 3: Which Obstacles Hinder Participation in Manpower Development Initiatives?

Mr Lincoln Teo, Chief Operating Officer of DP Info said upgrading the skills of their employees will be a major challenge for SMEs in the next few years.

“Singapore is entering a slow growth period and most SMEs are experiencing challenges growing their revenue while managing cost and improving productivity. Implementing training and development strategies while keeping their employees focused on the business is a delicate balance.”

“In the last few years the focus has been on SMEs becoming leaner and more productive to stay competitive. Many SMEs simply do not have the capacity to redeploy their employees into training as it will impact the day-to-day operations of their company.”

“Employing agile and technology-based training programmes such as scenario-based learning could be a more impactful investment for the SMEs and their workforce.”

“Cost is always an issue which limits how much SMEs are prepared to invest in training. With the majority spending less than $500 per employee per year, it appears SMEs are doing the training they have to do, rather than the training they might want to do.”

“A proportion of SME expenditure on training may not go into direct skills upgrades for their employees, but can be is undertaken for compliance as well as safety reasons.”

“In industries like construction and manufacturing, occupational health and safety rules require staff to be regularly given safety training. In the Infocomm and Services sectors, training is often done to give them knowledge to comply with laws on data protection, privacy or a range of other regulatory requirements,” Mr Teo said.

SME FINANCING EMERGES AS A TOP CONCERN

This year a significant new challenge has emerged for SMEs to grapple with – access to financing and the cost of funds.

First, the percentage of SMEs with financing issues has risen from 14 percent last year to 22 percent this year.

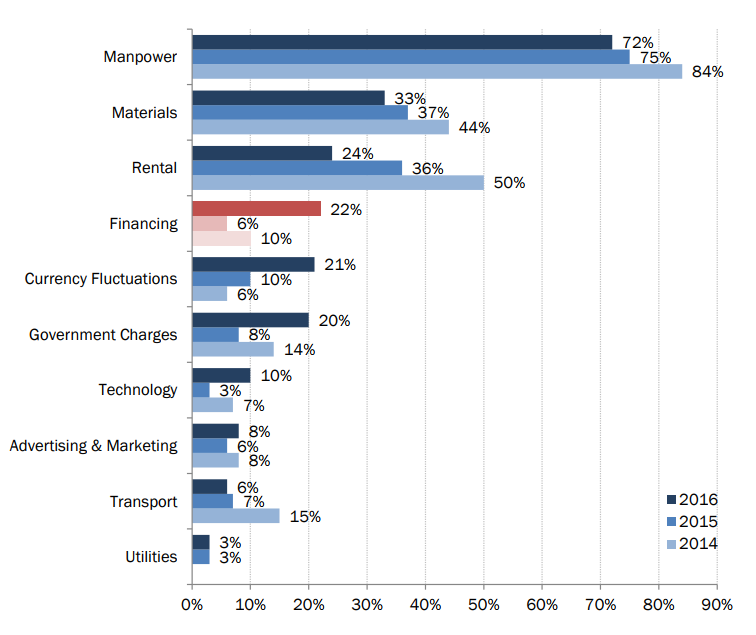

Second, financing is now the fourth biggest cost issue facing SMEs – behind manpower, materials and rent. The number of SMEs having difficulty coping with the cost of financing has leapt from six per cent last year to 22 per cent this year.

Table 5: Cost Components Companies Face Difficulties Coping With

Of the SMEs with financing issues, 46 per cent nominate higher bank interest rates as the biggest problem while 19 percent have to provide more collateral to maintain their loans.

SMEs are also being squeezed harder by their suppliers with 34 per cent now indicating tighter access to supplier credit as an issue.

Table 6: Top 5 SME Financing Issues

The impact of the tightening of credit available to SMEs is starting to have a significant impact on the cash flow of companies. Cash flow problems are now the top business concern of seven percent of SMEs – twice as many last year when it was just three per cent.

Commenting on the financing issues facing SMEs, Mr Teo said: “Banks and financial institutions have become more cautious when lending to SMEs, and this is reflected in a higher cost of funds.”

“A lack of access to affordable financing can trap SMEs in a downward spiral where they cannot grow without more funds, but cannot get funds without more growth.”

“With both financial institutions and suppliers making access to credit harder, SME leaders need to have good management skills to avoid having cash flow problems. This means being more vigilant in the credit they offer and avoiding bad loans and defaults from customers.”

“It has never been more important for SMEs to make full use of the credit management tools available to them including credit rating checks on companies they do business with, and pooling payment information with other SMEs by joining a credit bureau,” Mr Teo said.