Nearly 50% of Migrant Domestic Workers in APAC are unbanked, says report commissioned by Experian

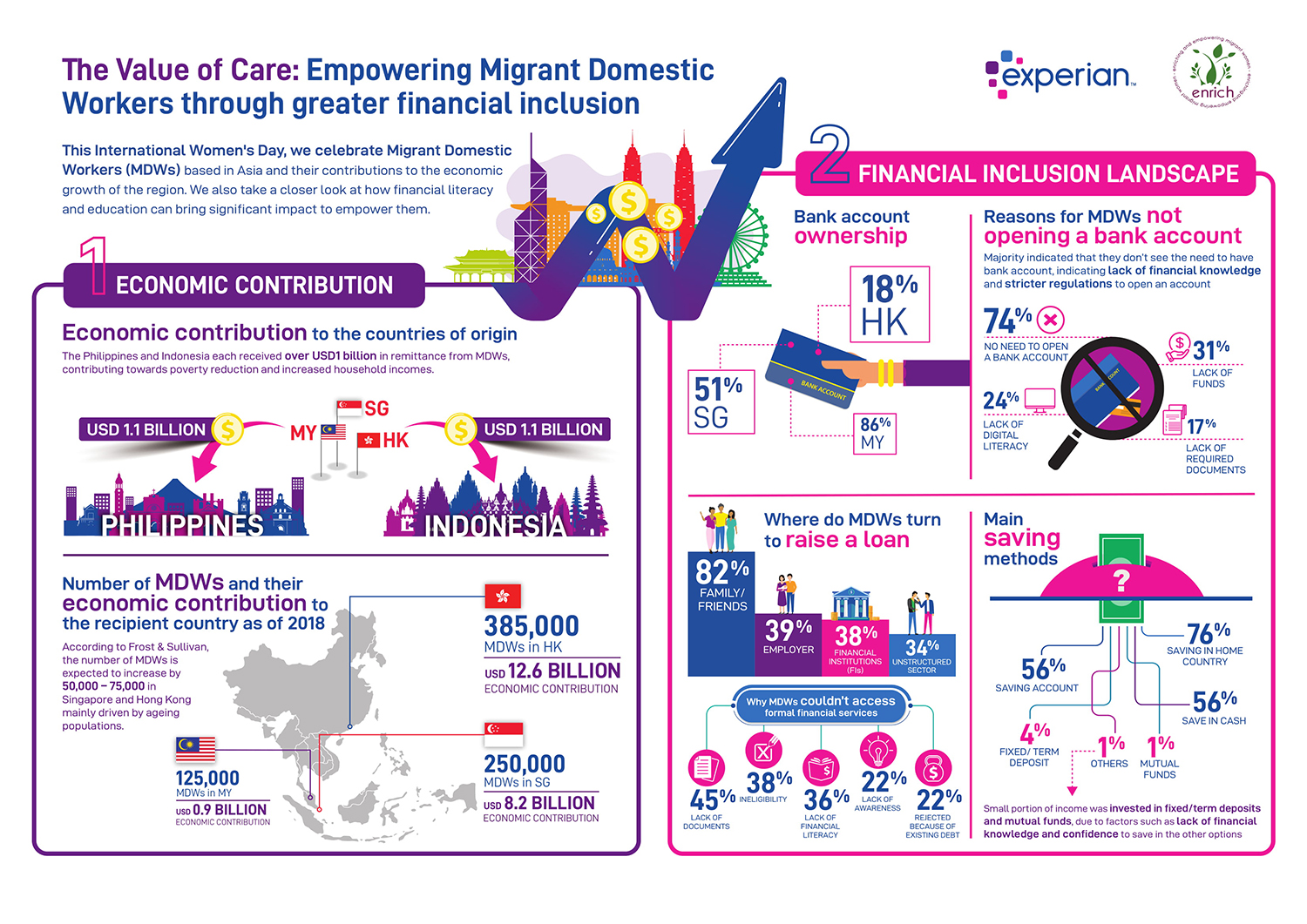

Experian, the world leader in information services, today announced the findings of a Market Intelligence Report on migrant domestic workers (MDWs) by Frost & Sullivan. The Value of Care: Key Contributions of Migrant Domestic Workers to Economic Growth and Family Well-being in Asia study revealed that nearly 50% of MDWs in Hong Kong, Malaysia and Singapore do not have a bank account, illustrating a low level of financial access and literacy amongst MDWs in the region. This is despite the significant economic contributions by MDWs to the countries they work in, which reached a total of nearly USD22 billion in 2018. Commissioned by Experian in partnership with charity organisation Enrich, the Frost & Sullivan report surveyed 300 MDWs in Hong Kong, Malaysia and Singapore on their personal finance habits and contributions to the economy.

The report highlighted a positive economic impact generated by MDWs in both the countries they come from as well as those they work in. In 2018, an estimated USD12.6 billion was added to Hong Kong’s economy by MDWs, accounting for 3.6% of its GDP, while MDWs contributed USD8.2 billion to Singapore’s economy or 2.4% of its GDP. These contributions are mainly associated with the personal spending by MDWs and an increase in the labour participation rates of the families who hire them. MDW home countries also benefited significantly from the income earned overseas, contributing towards poverty reduction and increased household incomes in Indonesia and the Philippines. Both markets each received over USD1 billion in remittance from their MDWs in Hong Kong, Singapore and Malaysia.

While the economic contribution of MDWs is apparent, the report found that many are financially excluded and in debt. Only 18% and 51% of MDWs working in Hong Kong and Singapore, respectively, have a bank account. The majority (74%) do not currently see the need to have a bank account, indicating a lack of financial knowledge and awareness amongst MDWs in the region. At the same time, 83% of Hong Kong’s MDWs are in debt, followed by two-thirds of them in Malaysia and one-third in Singapore. The high level of debt is mainly attributed to existing loans raised when dealing with family emergencies, with loans provided to MDWs by their families, friends or employers, instead of relying on financial services.

“Migrant domestic workers are the unsung heroes of our socio-economic future. Their contributions significantly benefit economies across the region, the families they provide for in their home countries as well as the -households they work with and support,” said Sisca Margaretta, Chief Marketing Officer, Experian Asia Pacific. “The report findings highlight areas that require urgent action. Beyond leveraging alternative data to build financial identities for the region’s unbanked, Experian is collaborating with social organisations, such as Enrich in Hong Kong and Aidha in Singapore, to spearhead financial education and mentoring programmes for migrant domestic workers. Only by arming all socio-economic groups with financial knowledge and access will we be able to start addressing the financial difficulties they face and help resolve the region’s financial inclusion challenges.”

Lucinda Pike, Executive Director of Enrich, said “Despite their valuable contributions, migrant domestic workers often lack the financial access and awareness they need to unleash their full economic potential. Financial education is a life-changing solution that will address this gap. Our continuous partnership with corporate organisations such as Experian will empower and enable migrant domestic workers with the knowledge to further secure their financial futures.”

Facilitating equal opportunities for financial inclusion across genders and socio-economic groups is key to developing thriving economies and communities in Asia Pacific (APAC). Experian is driving various social innovation programmes to empower the region’s unbanked, underbanked and financially illiterate through greater access to financial education and services that better meet their needs. To date, the company has educated 30,000 low-income individuals in India, especially women, on digital financial services; worked with 2,000 women in Vietnam to improve financial education levels and daily earnings; and supported thousands of female migrant domestic workers in APAC with financial literacy programmes.