150% increase in time retail companies take to settle a debt

SINGAPORE, 17 July 2018: Manufacturing and retail – two industries whose very different fortunes can be seen in the way they pay their bills.

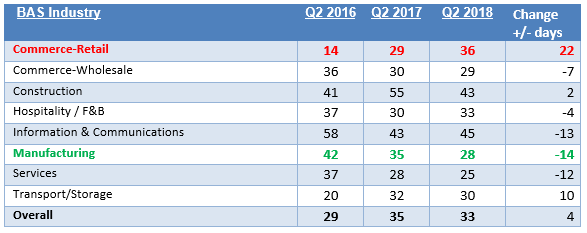

In the last three years, the manufacturing sector has been the biggest improver when it comes to payment behaviour. The sector has slashed 14 days off the average time a company takes to pay a debt – from 42 days in Q2 2016 to 28 days in Q2 2018.

In contrast, the average time taken for a retail company to pay up has increased by more than 157 per cent, from 14 days in Q2 2016 to 36 days in Q2 2018.

Figure 1: DTC – Q2 2016 to Q2 2018

The payment behaviour of the two sectors is revealed in an analysis of the quarterly Days Turned Cash National Average (DTC) – a measure of how quickly SMEs pay their debts. The DTC is compiled and published by DP Information Group (DP Info), part of the Experian group of companies, and is based on the payment data of more than 120,000 companies.

Two other sectors have shown a strengthening of their payment behaviour. The Information and Communications sector is now paying their debts 13 days faster than three years ago, while the Services sector is paying their debts 12 days faster.

Mr James Gothard, General Manager, Credit Services & Strategy SEA of Experian said Singapore’s manufacturing sector is experiencing a revival, and this strong performance is leading to quicker settlement of debts.

“Singapore is enjoying a manufacturing renaissance with double digit growth year on year1. Led by the biomedical and electronics sectors, manufacturing companies are enjoying the type of growth other sectors can only be envious of.”

“Sustained growth has led to improved cashflow and creditworthiness among manufacturers. With more cash in the bank they are settling their debts faster, which is good news for their suppliers.”

“The last three years have not been easy for retail companies. Manpower and rent costs have combined with the growth of online shopping to make life tough. Higher costs, lower sales and fierce competition are a formula for thinning margins and cash flow pressures. This explains why retailers are increasingly slow paying back money they owe.”

“There are signs of a pickup in the retail sector with overall retail sales edging up 2.2 per cent in May2 . And the Government’s recently announced Industry Transformation Map promises to drive the sector towards the cutting-edge of digital commerce.”

“While they may be slower in payment, retail companies have the lowest level of severely delinquent debt, with just six percent of money owed still unpaid after 90 days. So if an SME is worried about a retail company that owes them money they should join an SME credit bureau. That way they will get an early warning if the debtor company’s payment behaviour deteriorates,” Mr Gothard said

[1]: On a year-on-year basis, Singapore’s manufacturing output increased 11.1% in May 2018. Source: EDB (https://www.edb.gov.sg/en/news-and-resources/news/monthly-manufacturing-performance.html)

[2]: Excludes motor vehicle sales; Retail Sales Index, May 2018. Source: Department of Statistics Singapore (https://www.singstat.gov.sg/-/media/files/publications/industry/mrsmay18.pdf)