- Latest survey of 3,600 Singapore-based SMEs by SBF and Experian shows small uptick in general sentiments for the first time in the past four quarters at 50.8, though it is at its lowest 3Q-4Q year-on-year reading in the last six years

- However, the appetite of SMEs for business expansion, especially in the Retail / F&B and Transport / Storage sectors, remains.

SINGAPORE, 27 June 2019 – Singapore SMEs remain cautiously optimistic about business prospects in the next six months, with key economic sectors showing a slight uptick in reading, according to the latest SBF-Experian SME Index (“the Index”).

The ongoing trade tensions between US and China has cast a shadow over the Singapore economy. Notwithstanding a slight increase in the reading from 50.4 to 50.8 this quarter, the Index has fallen 1.95% year-on-year and is the lowest 3Q – 4Q reading in the last six years.

Similarly, Ministry of Trade and Industry noted that the global growth outlook remains clouded by uncertainties and downside risks including the escalation of trade tensions between the US and its key trading partners especially China, a slower-than-expected growth in the Chinese economy, and a possible “no-deal Brexit” in Britain’s withdrawal from the European Union.

The Index – a joint initiative of the Singapore Business Federation (SBF) and Experian – measures the business sentiment of SMEs in Singapore for the next six months (July 2019 to December 2019). The Index comprises inputs from SMEs on their expectations in seven key areas – Turnover, Profitability, Business Expansion, Capital Investment, Hiring, Capacity Utilisation, and Access to Financing. This index is based on a survey of more than 3,600 SMEs conducted between 15 April and 24 May 2019.

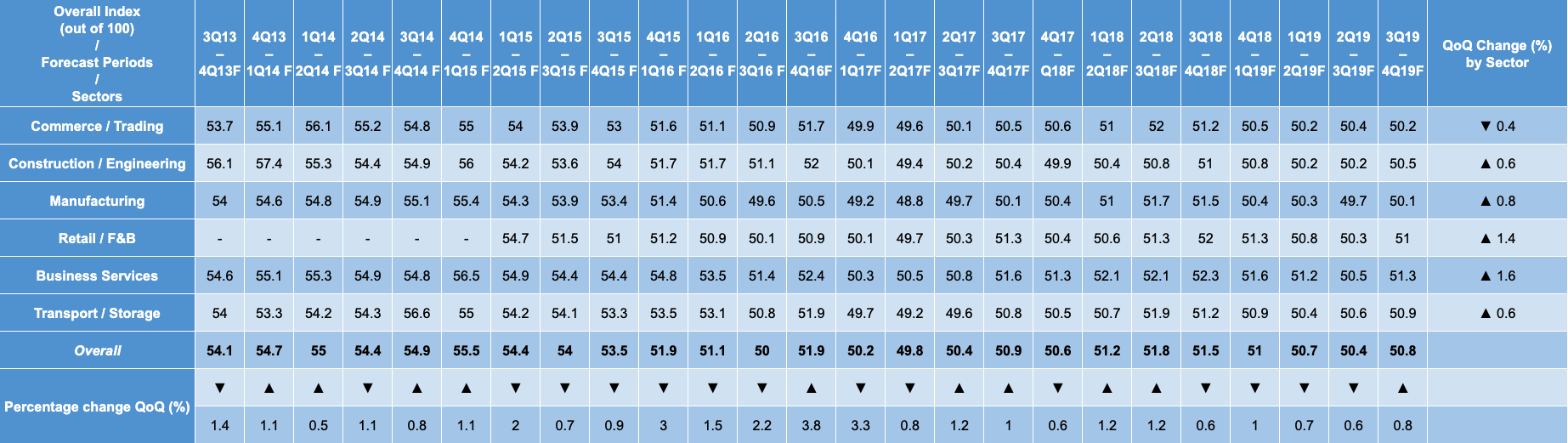

Figure 1: Outlook for 3Q2019 – 4Q2019F (July 2019 to December 2019)

With optimism in short supply amid muted market sentiments, the latest Index highlights an improvement in both Turnover Expectations (from 5.03 to 5.19) and Profitability Expectations (from 4.94 to 5.09) as the two biggest uplifts among the seven expectations measures. SMEs are possibly banking on the year-end festive season to provide seasonal impetus to their businesses.

Trade tensions impacting Commerce / Trading SMEs

External-facing SMEs in the Commerce / Trading sectors continue to expect depressed profitability. Neutral turnover growth from dampened external sentiment and having to maintain fixed overheads look to be dragging down profit growth.

Escalating US-China trade tensions have also likely tempered investment appetite for the Commerce / Trading sector (down 0.58% to 5.11). This is the lowest the reading since 4Q12 – 1Q13 (at 5.08), highlighting growing concerns of the sector over the protracted trade war.

The Commerce / Trading sector has also seen a dip in Business Expansion Expectations (down 1.13% to 5.23). Even as the sector remains positive on expansion, the optimism is likely dampened by the escalating trade war.

SMEs in Commerce / Trading saw the biggest drop in expectations on Access to Financing (down 2.75% to 4.95). Lenders are understandably more cautious in injecting fresh funds into a sector directly impacted by the potential global trade disruption.

Find out more about Experian’s Research Capabilities.

SMEs continue to hunt for opportunities in region

Business Expansion Expectations and Capital Investment Expectations remain positive this quarter at 5.38 and 5.19 respectively, as growing global headwinds may be driving SMEs to pursue new growth opportunities.

The Retail / F&B segment continues to trend upwards in Business Expansion Expectations (up 1.81% to 5.63) as the F&B sub-segment sees greater expansion opportunities, both in the online delivery space and in physical outlets. With an MOU signed by ASEAN restaurant associations, F&B SMEs may be looking at introducing innovative dining concepts to the rest of Southeast Asia. The MOU is expected to help the F&B sectors in Singapore and other regional countries to expand into ASEAN markets, along with promoting best practice sharing.

The Transport / Storage has also seen a boost in expectations (up 2.27% to 5.40). This is likely due to the sector seeing longer-term opportunities within ASEAN and China, bolstered by the recent formation of the China-ASEAN Multimodal Transport Alliance.

An open trade economy like Singapore is likely to be affected in today’s suboptimal macroeconomic environment, intensified by uncertainties from the ongoing trade tensions and a general economic slowdown across ASEAN. This is evident from the SMEs Commerce / Trading sector as they are the only sector this quarter to see a fall in optimism. However, we do see an uptick in sentiments in other sectors as SMEs are planning to take advantage of Budget 2019 measures and the upcoming holiday spending season,” said James Gothard, General Manager, Credit Services & Strategy, Southeast Asia, Experian.

Mr Ho Meng Kit, SBF CEO, said, “The slight rebound in sentiments, buoyed primarily by the retail, F&B and business services sectors, could be due in part to seasonal effects, such as expectations of the year-end holiday season. The ongoing trade war between US and China has knock-on effects on global growth and we have seen the trimming of Singapore’s growth forecast with our factory orders and exports affected.”

“Our businesses should not pin their hopes on a resolution in the trade war anytime soon as the current trade tensions are fueled by underlying problems that run deep. Business sentiment therefore could deteriorate further. In this time of uncertainty, we urge our SMEs to focus on upgrading, training, transformation and diversification of inputs and markets while they continue to seek opportunities in the global supply chain shifts in the region and beyond. SBF remains open and ready to extend a helping hand to businesses affected by the trade war.”

REBRAND OF DP INFORMATION GROUP TO EXPERIAN

DP Information Group is now Experian in Singapore. It was officially rebranded in May 2019; creating a single, unified business that offers customers increased access to a broader range of solutions across Credit Services and Decision Analytics, powered by the global scale and industry-leading capabilities of Experian.

For over 40 years, DP Info has provided industry-leading reports that give insight into the Singapore economy, its industries and principally, its SMEs. It has shared knowledge around subjects such as business sentiments and payment behaviours. These reports have been cited by government, embassies, trade organisations, banks, universities and libraries. They continue to be referenced in the media as well as in the public and private sectors. With the rebrand, all studies are now renamed and rebranded as Experian reports.

The “SBF-DP SME Index” is now the “SBF-Experian SME Index”.