Growth of private wealth and insurance in the region cementing Singapore as the region’s premier financial centre

SINGAPORE, 16 February 2017 – The strong performance of Singapore’s finance companies in the 2017 Singapore 1000 (S1000) rankings confirms the nation’s position as the region’s premier financial centre.

The S1000 – which is celebrating its 30th anniversary this year – ranks the largest 1,000 companies in Singapore by revenue1, while the SME 1000 ranks the performance of the top 1000 SMEs. They are published together with the Singapore International 100 which tracks the performance of Singapore’s top performing internationalised companies.

The ranking body and publisher is DP Information Group (DP Info), part of the Experian Group of companies. The rankings are co-produced by EY who provide independent verification of the accuracy of the results and confirm their validity.

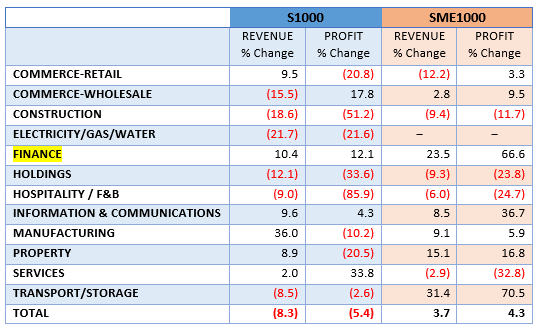

According to the latest rankings released today, the finance sector was the only industry to achieve double digit revenue and profit growth in both the S1000 and the SME1000 rankings.

Compared to the 2016 rankings, the S1000 finance companies increased their combined revenue by 10.4 per cent from S$107.2 billion to S$118.3 billion.

Their combined profit increased by 12.1 per cent from S$24.2 billion to S$27.1 billion.

The SME1000 finance companies also performed strongly with revenue increasing by 23.5 per cent from S$593.8 million to S$733.4 million, while their combined profit rose an impressive 66.6 per cent from S$128.8 million to S$214.5 million.

Table 1: 2017 revenue and profit by industry – % change from 2016

Reflecting the sector’s strong performance, finance companies increased their representation in both the S1000 and the SME1000 rankings compared to last year. In the S1000, the number of finance companies increased from 33 to 39 while in the SME1000 their numbers increased from 24 to 26.

There are several reasons why Singapore is cementing its position as the region’s premier financial centre. First, Singapore is benefiting from the growth of private wealth in the region, with the Asia-Pacific’s private wealth overtaking that of North America for the first time last year2. Singapore’s reputation for stability, together with a highly developed and innovative wealth management sector is seeing the nation attract a substantial share of investment from wealthy individuals.

Second, South-east Asia has a relatively low level of insurance penetration and is experiencing growth in the value of gross written premiums. Singapore firms have recorded strong growth in written premiums in both the life insurance and general insurance categories3.

Mr Sonny Tan, General Manager of DP Info said the S1000 results confirm Singapore’s standing as the region’s leading financial centre.

“In 2016 Singapore moved to third position on the Global Financial Centre’s Index4, making it Asia’s leading financial hub.”

“It is clear from this year’s S1000 that the strong performance of the nation’s finance companies is a major reason Singapore is moving up the international financial services rankings.”

“Singapore is home to some of the best run and most profitable financial companies in the world. The nation’s strong business culture, efficiency and skilled workforce continue to attract world-class companies to set up here.”

“We expect the next wave of growth for the finance industry will be driven by financial technology as Singapore’s fintech sector develops its competencies and infrastructure.”

“Starting in 1987, the Singapore 1000 rankings are an invaluable record of the strengths, weaknesses and triumphs of Singapore’s corporate community. With this 30th anniversary of the S1000, we are planning activities throughout the year to celebrate the achievements of Singapore’s best corporate leaders, as well as identifying the business stars of the future,” Mr Tan said.

Mr Lim Tze Yuen, Assurance Partner, Ernst & Young LLP said the Singapore 1000, SME1000 and Singapore International rankings are an enormous undertaking.

“Each year the annual returns of more than 70,000 companies are reviewed and analysed to arrive at the final lists.”

“The reason these rankings and awards have endured for three decades is due to the objective, data-driven approach built into the ranking’s methodology,” Mr Lim said.

PROFITABILITY

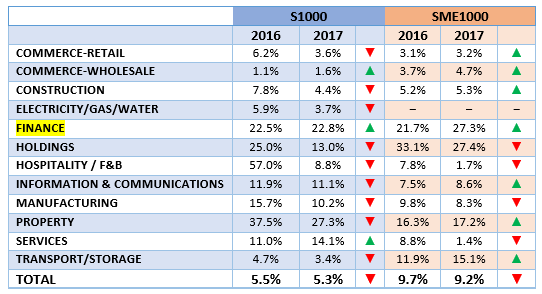

Finance companies were the only sector to improve their margins in both the S1000 and SME1000 ranking. Finance companies also have among the highest profit margins of any industry sector, with both the S1000 and SME companies generating profit margins above 20 per cent.

Amongst the S1000 ranked companies, those from the property sector achieved the highest margins (27.3 per cent), followed by Finance (22.8 per cent) and Services (14.1 per cent).

Holding companies had the highest profit margins among SMEs (27.4 per cent), followed by finance (27.3 per cent) and property companies (17.2 per cent).

Table 2: S1000 and SME1000 profit margins by sector

SINGAPORE 1000 – OVERALL PERFORMANCE

The combined revenue of Singapore’s top 1000 companies fell by 8.3 per cent to S$2.8 trillion compared to the 2016 ranking period.

The reason for the decline was a S$329 billion drop in the revenue of the Commerce-Wholesale Fuels sector. This drop was a result of the rapid drop in oil prices.

At the start of the 2016 ranking period (June 2014) crude oil prices were above US$100 a barrel. By the start of the current ranking period (June 2015) the price per barrel had fallen to US$60 per barrel, falling to $29 in January 2016.

If the Commerce-Wholesale Fuels sub-sector and its large drop in revenue were excluded from the rankings, then the combined revenue of all other sectors in the S1000 would have risen by S$80 billion.

The combined profits of the S1000 companies fell by 5.4 per cent to S$165.4 billion, mainly due to decreased profits in the property and manufacturing sectors.

SME 1000 OVERALL PERFORMANCE

Singapore’s top 1000 SMEs increased both their combined revenue and profits compared to the 2016 ranking. Combined revenue rose by 3.7 per cent to S$30.2 billion, while combined profits rose 4.3 per cent to $3.5 billion.

Transport/Storage SMEs performed strongly increasing their numbers in the top 1000 from 106 to 124. This increased representation drove their combined revenue up by 31.4 per cent to S$3.5 billion and their profits up by 70.5 per cent to S$566.6 million.

S1000 FIVE-YEAR PERFORMANCE

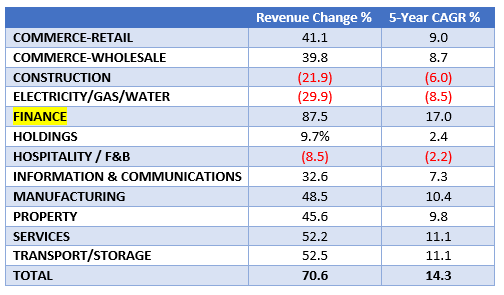

An analysis of the performance of each sector during the last five years again confirms that the finance sector is the standout performer.

In the 2012 S1000 Ranking, Finance companies generated a combined revenue of $63.1 billion. In this year’s ranking they generated $118.3 billion in sales – an increase of 87.5 per cent in just five years. This translates into a five-year CAGR of 17.0 per cent.

The next best performing sector was Transport/Storage sector which grew its revenue by 52.5 per cent in five years with a CAGR of 11.1 per cent.

The Finance sector is also the only industry that increased its revenue each of the last five years.

Table 3: S1000 Companies – 5-year Revenue Analysis (2012 to 2017)

SINGAPORE INTERNATIONAL 100 (SI100)

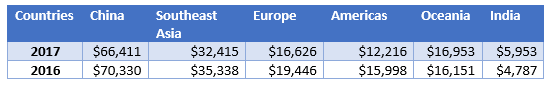

The overseas revenue of the top 100 internationalised companies in Singapore fell 9.9 per cent to S$185.9 billion compared to 2016. This follows the 8.7 per cent decline in international revenue last year.

Sales from China, Southeast Asia, Europe and America were all lower than in 2016, although increased sales were recorded from Oceania and India.

Table 4: Revenue of Top 100 Internationalised Companies by Region (S$’million)

ABOUT THE RANKINGS

The Singapore 1000, SME 1000 and Singapore International 100 are ranked and published by DP Information Group with EY as Co-Producer. It is supported by the Singapore Business Federation, IE Singapore, SPRING Singapore, ACRA and IMDA. Official Media Partners are The Business Times and Fortune Times.

[1] Ranking period: 1 June 2015 – 31 May 2016

[2] https://www.straitstimes.com/business/private-wealth-in-asia-pacific-exceeds-n-americas

[3] http://asia.insurancebusinessmag.com/asia/news/breaking-news/asean-gross-written-premiums-up-by-2-9-for-2015-227453.aspx

[4] http://www.longfinance.net/images/PDF/GFCI19_press_release.pdf