Drop in the proportion of debts unpaid 90 days after falling due shows SME financial health is improving

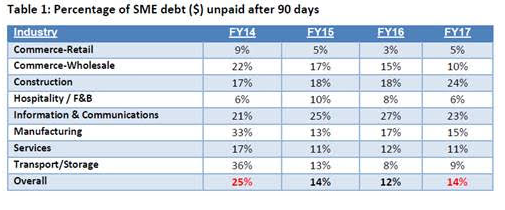

SINGAPORE, 01 February 2018: Singapore SMEs have improved their debt payment behaviour during the last three years, with the proportion of severely delinquent debts dropping from 25 per cent in 2014 to 14 per cent in 2017.

Severely delinquent debts are those which remain unpaid more than 90 days after falling due. When a bill remains unsettled for this long it is often an indication of financial problems within the debtor company.

This change in SME payment behaviour was revealed in new research released today by DP Information Group (DP Info), part of the Experian group of companies. The research analyses the payment patterns of more than 120,000 companies in Singapore between 2014 and 2017.

The Transport/Storage sector recorded the biggest drop in severely delinquent debts during the last three years. In 2014, 36 per cent of the value of all Transport/Storage SME debts were unpaid after 90 days. In 2017 the proportion was just nine per cent.

Another industry which recorded a significant reduction is Manufacturing which had 33 percent of all debt deemed severely delinquent in 2014, compared to just 15 per cent in 2017.

Only two industries recorded an increase in severely delinquent debts since 2014 – the Construction sector (17 per cent in 2014 to 24 per cent in 2017) and the Information and Communications sector (21 per cent in 2014 to 23 per cent in 2017).

Mr Dev Dhiman, Managing Director, South East Asia & Emerging Markets for Experian pointed to several reasons for the reduction in severely delinquent debts.

“SMEs have been enjoying better trading conditions in the local and global economies which have boosted their financial strength. The Singapore economy is improving with GDP revised upward. Singapore’s exports and visitor numbers have also been rising. The US and the Eurozone are both showing stronger than expected growth while Chinese growth remains strong.”

“During the last three years, SMEs have adjusted to the restrictions on foreign manpower and the need to invest in technology and innovation. As these adjustments have been made, the cash flow position of most SMEs has improved, freeing up funds for the prompt settlement of debts.”

“SMEs have become more vigilant in pursuing outstanding debts during the last three years. Many have tightened the credit terms they extend to other companies which has contributed to a more rapid payment cycle between SMEs,” Mr Dhiman said.