Manufacturing & wholesale companies displaced by service & infocomm companies

20 September 2016 [SINGAPORE] – Singapore’s corporate sector has undergone dramatic changes during the last decade, and nowhere is the transformation more apparent than in this year’s Fastest Growing 50 (FG50) Awards list.

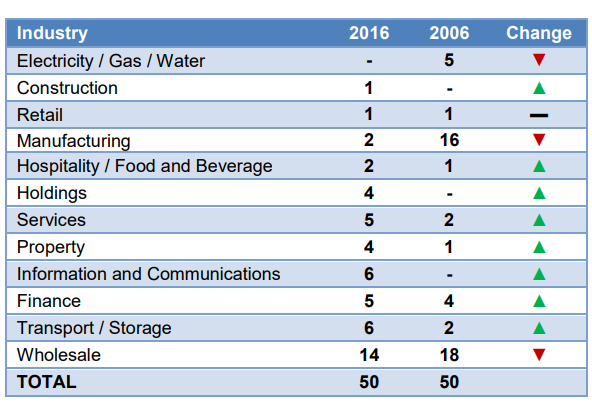

Ten years ago, the bulk of the FG50 companies came from just two industries – wholesale trade (18 companies) and manufacturing (16 companies). This year these two industries contributed just 16 of the 50 fastest growing companies, compared to 34 a decade ago.

This year’s FG50 winners come from a diverse range of industries, including services, infocomm, property and transport.

In this year’s FG50 Award’s list there are:

- Six infocomm companies compared to zero in 2006

- Six transport and storage companies compared to two in 2006

- Five service companies compared to two in 2006

- Four property companies compared to one in 2006

TABLE 1: FG50 2016 Composition by industry sector

The FG50 is compiled by DP Information Group (DP Info) and identifies companies that achieved a minimum of 10 per cent turnover growth every year for the last three years while remaining profitable each year. The qualifying companies are then ranked by their three year

Compounded Annual Growth Rate (CAGR), with the top 50 receiving a FG50 Award.

DIVERSITY: A POSITIVE FOR SINGAPORE

Mr Lincoln Teo, Chief Operating Officer of DP Info said the changes are a positive trend for Singapore.

“The last decade has been one of economic change in Singapore as the traditional powerhouse industries of wholesale trade and manufacturing have become less dominant within the economy.

“New industries have emerged to drive the growth of Singapore’s corporate sector, including the services and infocomm sector. The greater diversity of the Singapore economies is reflected in this year’s FG50 list which is now made up of a much wider cross section of companies than ten years ago.”

“The FG50 results do not mean wholesale and manufacturing companies are not growing. What it does show is more companies from other industries are growing faster right now.”

“Having a range of companies from a variety of sectors achieving rapid growth means the Singapore economy is not overly dependent on any one sector and that multiple industries are contributing to the nation’s growth,” Mr Teo said.

THE DRIVERS OF CHANGE

Wholesale Trade

Despite a lower level of representation than a decade ago, wholesale trade companies are still the largest single group within this year’s FG50. During the last decade, wholesale traders have had to navigate their businesses through numerous changes, including commodity and currency fluctuations. Growth in global trade volumes has remained relatively subdued since the global financial crisis, especially in developed economies. In recent years, a range of uncertainties have impacted on the growth of wholesale trade companies including the slowing of the Chinese economy, financial market volatility and exposure of countries with large foreign debts to currency movements.

Manufacturing

The manufacturing sector has had a challenging couple of years. The industry has been subjected to a high level of regional competition and domestic restructuring. Several multinational manufacturers have moved their production to other countries as the local industry was forced to adjust to a more expensive cost base as a result of changes in foreign labour policies.

Services

The services sector has become increasingly important to Singapore during the last two decades. It is a diverse part of the economy and includes activities such as business services, tourism and financial services. Following the pattern of other developed nations, the services sector has increased in importance compared to other industries such as manufacturing.

Infocomm

The last 10 years has seen the infocomm sector emerge as a key contributor to the Singapore economy. The Singapore Government has been active in developing the nation’s IT capabilities. The government’s strategy has seen the development of excellent IT infrastructure as well as a pool of highly tech-savvy workforce. This focus on infocomm has attracted leading global companies to establish a presence in Singapore, which in turn has created the environment for many home-grown infocomm companies to emerge and succeed.

THE FASTEST GROWING COMPANY IN SINGAPORE

This year’s fastest growing company in Singapore is Qingjian International (South Pacific) Group Development Co., Pte. Ltd. (Qingjian).

A property development company originating from China, Qingjian has completed numerous restigious property developments in Singapore as well projects in Myanmar and Indonesia.

Qingjian achieved a CAGR of 642 per cent between 2012 and 2015, well ahead of the second fastest growing company Ameropa Asia Pte Ltd which achieved a CAGR of 630 per cent.

One of Qingjian’s best known buildings is the soon to be completed Singapore Chinese Cultural Centre – an imposing 11 story building which includes a 530-seat auditorium, a 500-seat multipurpose hall, a recital hall, a visual arts gallery and a 2,000 square metre roof terrace garden.

CREDIT STANDING OF FG50 COMPANIES REMAINS STRONG

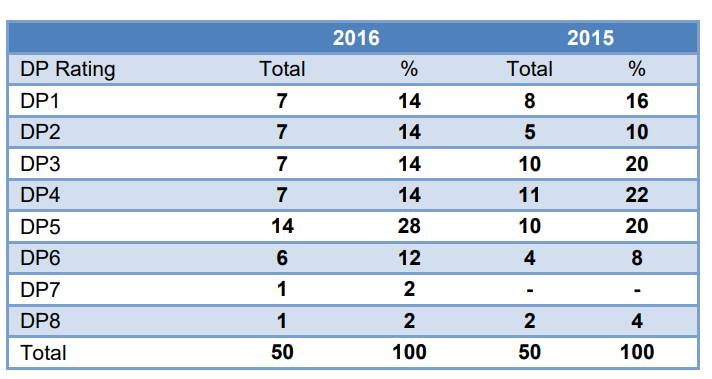

The majority of Singapore’s FG50 companies have excellent credit ratings, indicating their growth has not been achieved at the expense of prudent management.

Twenty-eight of the 50 companies have a DP1-4 Investment Grade credit rating, including seven with the prestigious DP1 rating. However, there has been a slight dip in the number of companies considered DP1-4 compared to last year – from 34 to 28. At the other end of the rating scale, only two companies are graded as DP7-8 High Risk.

A number of factors could have caused the dip in DP1-4 rated companies, including the increased number of smaller and younger companies in this year’s FG50 list. Smaller and younger companies may not yet have acquired the financial resources and assets to warrant a higher grade of credit rating.

TABLE 2: FG50 2016 by DP Credit Rating

SMEs MAKE A COMEBACK

The number of SMEs that are among Singapore’s fastest growing 50 companies has jumped from eight last year to 13 this year – the highest number in the last five years. This means a quarter of all FG50 companies are SMEs.

While the SMEs are growing their sales rapidly, their profit margins are well behind that of the larger S1000 companies. The average profit margin of the SMEs is 20 per cent, while for larger companies the average profit margin is 52 per cent.

While their profit margins may be lower than the larger award winners, an average profit margin of 20 per cent indicates the FG50 SMEs have very successful businesses models.

The “Fastest Growing 50” is organised and ranked by DP Information Group, the ranking body of the Singapore 1000 Family of Rankings.