- Sustained trade tensions have impacted external-facing sectors such as Commerce / Trading and Manufacturing, which registered declines in turnover and profitability expectations

- The slowing economy may have affected consumer sentiments, with the Retail / F&B sector showing declining optimism around business expansion and investment

- The Construction sector remains resilient, registering positive outlook on profit growth and hiring expectations, likely a result of a strong pipeline of public sector projects

SINGAPORE, 23 September 2019 –Singapore SMEs softened their business outlook for the next six months as a result of global economic headwinds, according to findings from the latest SBF-Experian SME Index (“the Index”).

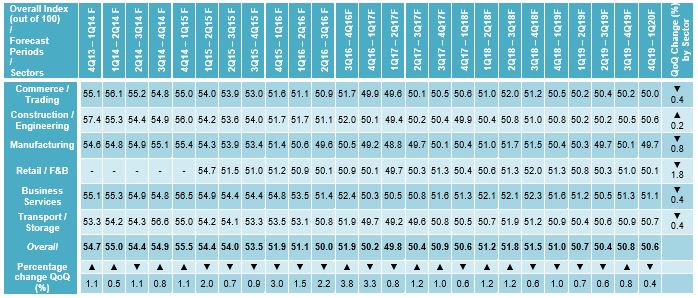

The global economy has slowed amidst the prolonged uncertainties cast by the ongoing US-China trade tensions, which has led to the Ministry of Trade and Industry’s (MTI) revising its GDP forecast for 2019 to “0.0 – 1.0%”, in line with private sector economists anticipating growth to decrease to 0.6%. The Index registered a decrease from 50.8 to 50.6 for the period 4Q19 – 1Q20, reversing the uptrend observed last quarter (from 50.4 to 50.8).

The Index – a joint initiative of the Singapore Business Federation (SBF) and Experian – measures the business sentiment of SMEs in Singapore for the next six months (October 2019 to March 2020). The Index comprises inputs from SMEs on their expectations in seven key areas – Turnover, Profitability, Business Expansion, Capital Investment, Hiring, Capacity Utilisation, and Access to Financing. This Index is based on a survey of more than 3,600 SMEs conducted between 8 July and 16 August 2019.

Figure 1: Outlook for 4Q2019 – 1Q2020F (October 2019 to March 2020)

Optimism has dampened among SMEs for the period 4Q2019 – 1Q2020, with declining expectations across all seven sub-indicators. The slowing economy have contributed to declines in Turnover Expectations (from 5.19 to 5.16), Profitability Expectations (from 5.09 to 5.06), Business Expansion Expectations (from 5.38 to 5.34), Capital Investment Expectations (from 5.19 to 5.14), and Hiring Expectations (from 5.17 to 5.08).

Impact of Sustained Global Headwinds on Retail / F&B SMEs

MTI expressed concerns in February that an escalation of the US-China trade war could impact both business and consumer confidence and affect spending.

While SMEs in the Retail / F&B sector displayed the most optimism for Turnover Expectations (5.30), it has registered an overall decline in sentiments, suggesting that local consumers may indeed be feeling the effects of the ongoing trade tensions. This is in line with the current trend of declining retail sales for the fifth consecutive month in June.

The sector registered the biggest slide in optimism around Business Expansion Expectations (down 2.49% to 5.49). This suggests that while Retail / F&B SMEs remain positive around growth opportunities, they may be managing their aspirations in view of a challenging business environment for the foreseeable future.

This is supported by the sector’s decline in Capital Investment Expectations, reversing three consecutive quarters of growth (down 2.22% to 5.28). With more conservative business expansion plans, SMEs would inevitably re-evaluate their capital investment commitments.

Commerce / Trading SMEs Remain Vulnerable to Ongoing Trade Tensions

The outlook among Commerce / Trading SMEs dipped to 50.0, the lowest reading since 1Q17 – 2Q17. With no apparent end in sight for the ongoing US-China trade war, Commerce / Trading SMEs are expecting lower trade volumes for 2019 and the first quarter of the new year. This has translated to negative Profitability (4.94) and Turnover (4.99) Expectations, representing the fourth straight quarter of negative profit growth expectations for SMEs in the sector.

Escalating trade tensions also appear to have softened investment appetite among Commerce / Trading SMEs, with a reading of 5.09 (down 0.39%) representing the lowest levels since 4Q12 – 1Q13. This may suggest that SMEs in the sector are scaling back growth prospects and doubling down on existing resources to tide them through protracted adverse economic conditions.

SMEs in the Commerce / Trading sector are also expressing concern around their Access to Financing Expectations (4.96), with lenders seemingly less inclined to provide funds to a sector that is highly exposed to global business risks.

Manufacturing Impacted by Declining Global Demand

Alongside the Commerce / Trading sector, Manufacturing SMEs posted one of the most significant dips in business outlook, demonstrating the impact of a slowing global economy on external-facing sectors.

The Manufacturing sector registered negative Turnover Expectations (4.98) as a result of a global slowdown in demand for manufactured goods. Profitability Expectations for the sector has also decreased (down 0.21% to 4.86), representing five consecutive quarters of negative profit growth expectations.

SMEs in the Manufacturing sector registered a decline in Hiring Expectations (down 3.47% to 5.00), likely as a result of firms adjusting their expansion and hiring plans in line with a more subdued outlook.

The Manufacturing sector also registered the biggest drop in Access to Financing Expectations (down 2.23% to 4.83), with lenders appearing to be more wary of extending loans to SMEs in a segment of the economy that has displayed ongoing weakness in its order books.

Construction Remains Resilient with a Strong Pipeline of Public Sector Projects

Amid muted market sentiments, Construction has emerged as the one resilient sector in the Singapore economy, having registered positive gains in several indicators.

The sector registered the most significant increase around Profitability Expectations (increased 1.80% to 5.09), turning positive for the first time since 4Q18 – 1Q19. The sector’s improved outlook has also seen Hiring Expectations turn positive (increased 1.4% to 5.07), making it the only sector to see an improvement in hiring.

These positive gains are likely to be due to strong public sector construction activities, with the Building and Construction Authority expecting 60% of construction demand in 2019 to come from the public sector. Major projects include the Tuas mega port, the Jurong Lake District, the expansion of the two integrated resorts, and public infrastructure projects initiated by the Singapore government since 2017.

However, SMEs in the Construction sector also saw a moderation around Capital Investments Expectations (down 1.34% to 5.14). Despite a strong pipeline of public sector projects, SMEs may be looking at balancing their cash and debt positions in view of a challenging environment.

“Prolonged trade tensions on the global stage and a slowing Chinese economy present some downside risks to the city-state’s trade-oriented economy. Besides the impact on external-facing sectors such as Commerce / Trading and Manufacturing, another troubling observation is the decline in optimism among SMEs in the Retail / F&B sector, potentially pointing to how the economic uncertainty may have impacted consumer sentiment, affecting internal-facing sectors. However, it is heartening to see the Construction sector remaining resilient, indicating that the government’s strategy to bring forward a slew of public sector projects is indeed paying dividends,” said James Gothard, General Manager, Credit Services & Strategy, Southeast Asia, Experian.

“With global headwinds showing no signs of abating, SMEs should also adjust their internal strategies in a bid to future proof themselves against sustained challenges in their business environment. This could include embracing digital solutions to boost efficiencies, or diversifying target markets to enhance their competitiveness,” added Mr Gothard.

Mr Ho Meng Kit, SBF CEO, said, “Our SMEs are bracing for greater economic headwinds ahead, as reflected by the dampened outlook for the next six months. The main drag on the economy has been manufacturing, especially electronics, and wholesale and retail trade, due to slower export momentum brought about by trade tensions and the downturn in the global electronics cycle.”

“The government has reassured our companies and Singaporeans that they are ready to step in to boost the economy, if needed. We’re seeing government spending in infrastructure and that’s a good start. But I think our businesses, too, can play a part. Our SMEs are expecting a tighter credit environment which may impact cashflow. Bigger companies can step up and help by providing timely payments and fair payment terms to their smaller partners and suppliers. We urge our SMEs to take a longer-term view and persist with transformation efforts so they can take advantage of the downturn to build new and better capabilities so they can be ready for the upturn.”

REBRAND OF DP INFORMATION GROUP TO EXPERIAN

DP Information Group is now Experian in Singapore. It was officially rebranded in May 2019; creating a single, unified business that offers customers increased access to a broader range of solutions across Credit Services and Decision Analytics, powered by the global scale and industry-leading capabilities of Experian.

For over 40 years, DP Info has provided industry-leading reports that give insight into the Singapore economy, its industries and principally, its SMEs. It has shared knowledge around subjects such as business sentiments and payment behaviours. These reports have been cited by government, embassies, trade organisations, banks, universities and libraries. They continue to be referenced in the media as well as in the public and private sectors. With the rebrand, all studies are now renamed and rebranded as Experian reports.

The “SBF-DP SME Index” is now the “SBF-Experian SME Index”.