- Though the overall Business Expansion Expectations reading remains positive, anticipated business uncertainties into 2020 have led to SMEs scaling back expansion plans, resulting in the lowest result registered since inception of the study.

- A protracted US-China trade war continues its impact on external-facing sectors such as Commerce / Trading which registered the biggest decline in overall sentiment this quarter.

- Sustained trade tensions appear to have a continued downward impact on consumer sentiments, with the Retail / F&B sector posting significant declines in turnover and profitability expectations over the quarter as the sector looks past the festive season to 2Q20.

- Manufacturing saw sentiments improving, with the sector registering an increase in Hiring Expectations as volumes stabilise.

SINGAPORE, 23 December 2019 – Uncertainties in the business environment as a result of the protracted US-China trade war has led to Singapore SMEs softening their business expectations for the first half of 2020, according to findings from the latest SBF-Experian SME Index (“the Index”).

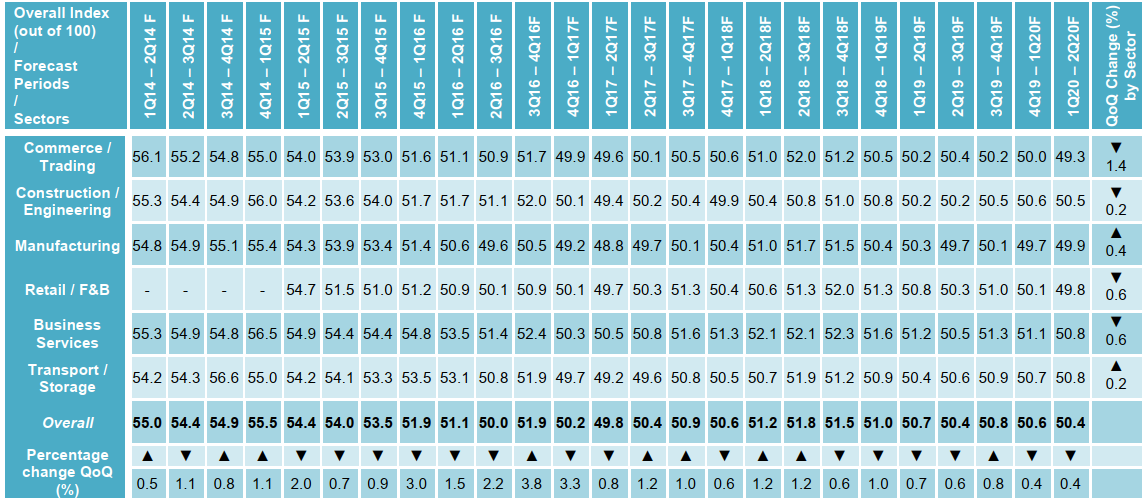

The Ministry of Trade and Industry (MTI) forecasted a GDP growth of “0.5 – 2.5%” for Singapore in 2020. Though the new year is tipped to bring modest growth, MTI cited possible risks that may persist from trade tensions and a slowdown in the Chinese economy. With these factors weighing on SMEs, the Index registered an overall decrease from 50.6 to 50.4 for the period 1Q20 – 2Q20F, continuing the downward trend observed from the previous quarter (from 50.8 to 50.6).

The Index – a joint initiative of the Singapore Business Federation (SBF) and Experian – measures the business sentiment of SMEs in Singapore for the next six months (January 2020 to June 2020). The Index comprises inputs from SMEs on their expectations in seven key areas – Turnover, Profitability, Business Expansion, Capital Investment, Hiring, Capacity Utilisation, and Access to Financing. This Index is based on a survey of more than 3,600 SMEs conducted between 7 October and 15 November 2019.

Figure 1: Outlook for 1Q20 – 2Q20F (January 2020 to June 2020)

Optimism has dampened among SMEs for the period 1Q20 – 2Q20F, with declining expectations across four out of seven sub-indicators. The slowing economy has contributed to declines in Turnover Expectations (from 5.16 to 5.09), Profitability Expectations (from 5.06 to 5.00), Business Expansion Expectations (from 5.34 to 5.27), and Capacity Utilisation Expectations (from 6.98 to 6.89).

SMEs Scaling Back Expansion Plans Amid Uncertain Economic Environment

Though the Singapore economy is anticipated to see modest growth in 2020, private sector economists have cautioned that recovery could be a slow process due to ongoing trade tensions and unrest in the region. The trade tensions may have already led to Singapore’s non-oil domestic exports (NODX) and total merchandise trade falling by 9.6% and 6.7% respectively in 3Q19.

Likely due to business uncertainties, increased competition and rising cost pressures, the latest reading for Business Expansion Expectations is the lowest since the inception of the SME Index in 2009 despite a positive reading of 5.27. All six sectors have scaled back theirexpansion plans for 2020, with the most significant impact being observed within the Business Services sector (from 5.38 to 5.23).

Construction remained the most resilient sector for this indicator, registering the smallest decrease (from 5.31 to 5.28). According to the MTI, this is due to sustained construction demand from the public sector, which is projected to drive the sector’s performance into 2020, continuing its robust performance from the previous quarter.

Commerce / Trading SMEs Continue to Face Challenges from Volatile Global Economy

External facing sectors are expected to continue facing business challenges in an uncertain global economy. The outlook among Commerce / Trading SMEs dipped to 49.3, breaking the previous low of 49.6 seen in 1Q17 – 2Q17F. The sector registered decreases across six of the seven indicators, with only Hiring Expectations remaining unchanged.

Notably, the trade war has led to a significant decrease in Turnover Expectations (down 3.21% to 4.83), the second consecutive quarter of negative expectations. This also contributed to the sector registering the sharpest fall in Profitability Expectations (down 3.85% to 4.75) among the six sectors with lower trade volumes expected for the first half of 2020, marking the fifth straight quarter with a negative reading.

SMEs in the Commerce / Trading sector may face challenges in terms of Access to Financing (down 2.62% to 4.83). Amid the ongoing uncertainty, lenders will understandably be more cautious in extending credit to a sector that remains at high risk of being impacted by global headwinds.

Difficulties in accessing growth capital may result in Commerce / Trading SMEs turning more conservative in terms of Capital Investment Expectations (down 0.59% to 5.06), marking the lowest reading registered since the inception of the SME Index in 2009. With no apparent end in sight for the ongoing US-China trade war, this may suggest that SMEs in this sector are tempering their investment appetites, seeking to maximise the potential of existing resources.

Impact of Global Trade Tensions on Domestic Facing Sectors

There are several indicators that suggest the trade war may have negatively impacted domestic facing sectors such as Retail / F&B. The latest figures released by the Department of Statistics indicated that Singapore’s retail sales fell 2.2% in September 2019, marking eight consecutive months of year-on-year decline.

Possibly an indication that consumer sentiment has been affected, Retail / F&B SMEs registered the most significant decline in Turnover Expectations (down 3.40% to 5.12) as the sector looks past the festive season to 2Q20. This may have impacted Profitability Expectations (down 2.14% to 5.04) for the sector, turning the outlook on profit close to neutral.

This may also have led to the sector tempering expectations around Business Expansion (down 1.09% to 5.43) and Capital Investments (down 0.76% to 5.24).

Stabilisation observed in Manufacturing sector, but Uncertainties Remain

The latest data from EDB indicated that factory production, excluding biomedical manufacturing, was up 0.2% year-on-year in October 2019, with the electronics sector registering a 0.4% growth. This could be an indication that the Manufacturing sector may be beginning to reverse a seven-month decline, an observation supported by similar findings by MTI.

The Manufacturing sector registered improvements across nearly all indicators this quarter. Turnover Expectations of Manufacturing SMEs have accordingly registered a reversal of an ongoing downward trend (up 0.60% to 5.01), suggesting that the sector may be seeing its order books stabilise in the first half of 2020. This led to a small uptick in Profitability Expectations (up 0.21% to 4.87), which however still points to negative profit growth expectations for the sixth consecutive quarter. Access to Financing Expectations has also increased (up 1.45% to 4.90), but the sector remains negative on their ability to access credit.

The Manufacturing sector also registered an increase in Hiring Expectations (up 2.20% to 5.11), possibly suggesting that Manufacturing SMEs are anticipating a need for more manpower to handle manufacturing volumes over 2020.

Despite the slight improvement in sectoral performance, companies may remain concerned about the escalation of the global trade war into the new year, and its potential impact on theirbusiness. This could have dampened Business Expansion Expectations among Manufacturing SMEs (down 0.96% to 5.18), the only indicator to register a decrease for the sector. While still expansionary, this set a new low Business Expansion Expectations reading for the sector, below the previous low mark of 5.23 registered in the previous quarter.

“Ongoing trade tensions have elevated uncertainties in the Asian business landscape, a development that is bound to impact export oriented economies such as Singapore. Despite signs that the Singapore economy is improving, SMEs, especially in the Commerce / Trading and Retail / F&B sectors, seem to be approaching the new year with caution, acknowledging the anticipated slow pace of the economy’s recovery and risks arising from global uncertainties,” said James Gothard, General Manager, Credit Services & Strategy, Southeast Asia, Experian.

“The government’s strategy for Budget 2020 is aimed at transforming, supporting, and sustaining businesses, providing them with the necessary assistance to innovate, go regional and build capabilities on the back of an increasingly challenging external environment. SMEs may want to consider new strategies to capitalise on potential opportunities and to build further resilience as the Singapore economy continues to transform,” added Mr Gothard.

Mr Ho Meng Kit, SBF CEO, said, “It’s important to note that the survey was done before the US and China came to an agreement on a Phase One trade deal. The mood at that time certainly dampened business sentiments among SMEs as the survey reflected. The question is whether this represents the floor and if sentiment will improve going forward. While we hope for some stability, our companies must be prepared to grapple with continued uncertainties as US and China work through the implementation of the agreement and commence further negotiations beyond Phase One. It is therefore wise for companies to take a watch-and-wait approach as the business environment in the first half of next year may continue to stay depressed.

“SMEs are also expecting a tighter credit environment. Hence support for short term financing lines such as invoice financing or the sharing of loan insurance risk premium could help to lift the sector and mitigate a widening of the credit gap. We also look forward to the expansion of Singapore’s digital banking sector which could improve access to finance for underserved SMEs in particular.”

Mr Ho added, “With economic uncertainties and global headwinds now the new normal, our SMEs cannot afford to carry on with business as usual. They need to continue to explore new markets which may now be more accessible and attractive with new Free Trade Agreements in place such as the EU-Singapore FTA and the anticipated signing of the Regional Comprehensive Economic Partnership next year. We urge our SMEs to continue to invest in business transformation efforts as well as the upskilling of their workers to boost productivity and strengthen their capabilities so they can be ready to ride on the recovery.”

REBRAND OF DP INFORMATION GROUP TO EXPERIAN

DP Information Group is now Experian in Singapore. It was officially rebranded in May 2019; creating a single, unified business that offers customers increased access to a broader range of solutions across Credit Services and Decision Analytics, powered by the global scale and industry-leading capabilities of Experian.

For over 40 years, DP Info has provided industry-leading reports that give insight into the Singapore economy, its industries and principally, its SMEs. It has shared knowledge around subjects such as business sentiments and payment behaviours. These reports have been cited by government, embassies, trade organisations, banks, universities and libraries. They continue to be referenced in the media as well as in the public and private sectors. With the rebrand, all studies are now renamed and rebranded as Experian reports.

The “SBF-DP SME Index” is now the “SBF-Experian SME Index”.